Insurance hasn’t changed much in the past few decades. The idea is always the same. If you face a big risk, you pay a small amount of money and feel secure.

But the business models for insurance have changed. And digital transformation projects open up new ways of working.

Buying products, claiming a policy, and customer care are all different with digital transformation. And that’s just the start. After all, there is a lot of variety in the insurance industry. Buying and claiming travel insurance is different from health insurance. And property insurance is very different once again.

So, digital strategies and technology can help insurance firms in many ways.

The impact of digital tools on insurance firms has been extremely positive. With improved efficiency, opportunities to cut costs, and enhanced customer satisfaction, digital transformation helps to bring insurance into the twenty-first century.

In this article, we’ll talk you through some of the main features of digital transformation for the insurance industry. In case you didn’t already know, we’ll remind you of the meaning of “digital transformation” before explaining how it works for the insurance industry.

We will also describe some of the important technologies for insurance, as well as the benefits and challenges of digital transformation in this sector.

- What is Digital Transformation In The Insurance Industry?

- The Digital Technologies Driving Insurance Digital Transformation

- Why Is Digital Transformation In The Insurance Industry important?

- Challenges for implementing Digital Transformation in Insurance Operations

- Implementing Digital Transformation: Insurance for the 21st century

What is Digital Transformation In The Insurance Industry?

If you’ve bought insurance for any reason recently, you’ve probably experienced digital transformation. Many features of digital transformation in insurance help customers. They are connected to deeper changes in business processes for insurance companies. All of these functions come from specific areas of digital transformation.

Digital transformation changes customer experience dramatically.

Today’s customers want to find quotations quickly and compare prices between companies. After they buy, customers need a digital interface to track their policy, compare tariffs, and make changes. Customer tools and portals can do much better than customer service personnel. Achieving this requires significant input.

These solutions also benefit businesses directly.

Self-service portals can connect customers very efficiently. In the background, digital power can calculate tailored quotations for every customer. Regarding claims, many new technologies can investigate damaged property very precisely. And all of these processes can be more secure since AI gives assurance around fraud.

Digital transformation solutions can offer efficiency for many insurance transactions. But if you want to know the best ways to use DX for your business, you must understand the key technology trends.

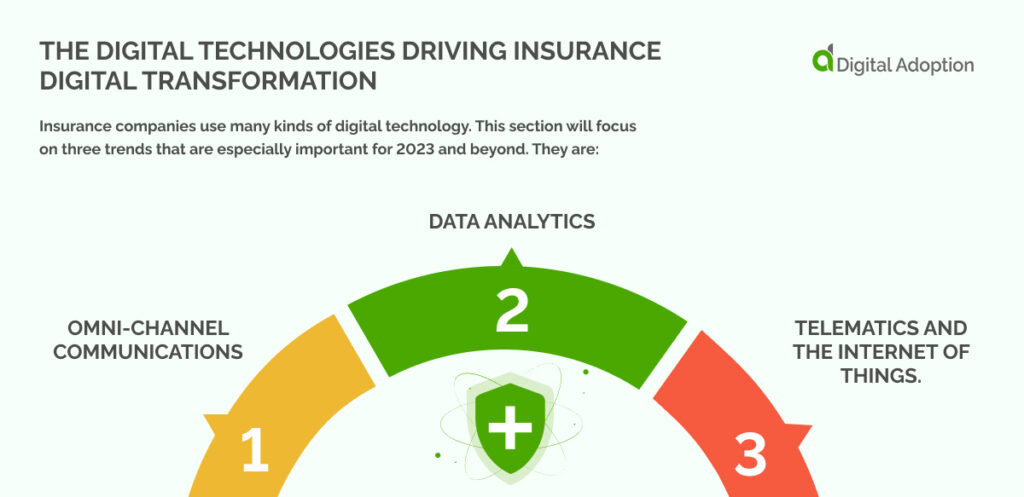

The Digital Technologies Driving Insurance Digital Transformation

Insurance companies use many kinds of digital technology. This section will focus on three trends that are especially important for 2023 and beyond. They are:

- Omni-channel communications

- Data Analytics

- Telematics and the internet of things.

Most companies can use these technologies to boost customer engagement, process big data, and collect information for claims. They will be implemented in different ways for every company. After all, these technologies are useful solutions – but only if they solve problems for a company.

Omni-channel communications

Big companies have many ways to communicate with their customers. A modern company may use social media, email, chatbots, customer service representatives, a self-service portal, physical storefronts, and more. Modern customers want all of these communication channels.

However, all these channels can be trouble. Perhaps customers have to keep re-entering their usernames. Or, maybe telephone customer service cannot locate the right information quickly. In such cases, customers go away with a bad feeling about the company.

That’s why customers must have a so-called “omnichannel” experience. Every channel should be connected. Moving from one channel to another must be seamless. This is difficult to achieve – but it’s essential for future-ready insurance companies.

Data Analytics

Digital transformations run on data. New technologies help businesses to collect a lot of data. That data is shared across the organization. And that’s useful – right?

Big data is only useful if the insurance company is analyzing it properly. So in a digital transformation, front-line technology is not enough. You need the staff and digital power to analyze the input.

More specifically, in the insurance industry, data analytics can power three key processes:

- Customers get accurate and tailored quotations. Companies use big datasets to understand thousands of variables and all the risk factors for a particular inquiry.

- When companies constantly monitor “normal” transactions, it is much easier to detect fraud. AI systems can detect anomalies much more quickly than humans. Even though these systems can be expensive, they will return the investment.

- Data helps businesses with customer segmentation. As a result, companies who know their clients can market specific products to specific customers.

Internet of Things and Telematics

These technologies collect information for insurance companies.

A McKinsey report explained that there are four main areas for IoT implementation in insurance: vehicles, housing, health, and commercial property. For example, insurance companies may implement IoT products in the homes of vulnerable people. In warehouses, digital devices can help produce very detailed risk assessments.

But the most common use of such technology is in automotive insurance. A telematics device in a car collects data on driving behavior. That can include speed, acceleration rates, braking, and driving distance. This data can create usage-based insurance policies, where customers pay premiums based on their driving behavior. This can lead to more accurate risk assessment and pricing and encourage safer driving.

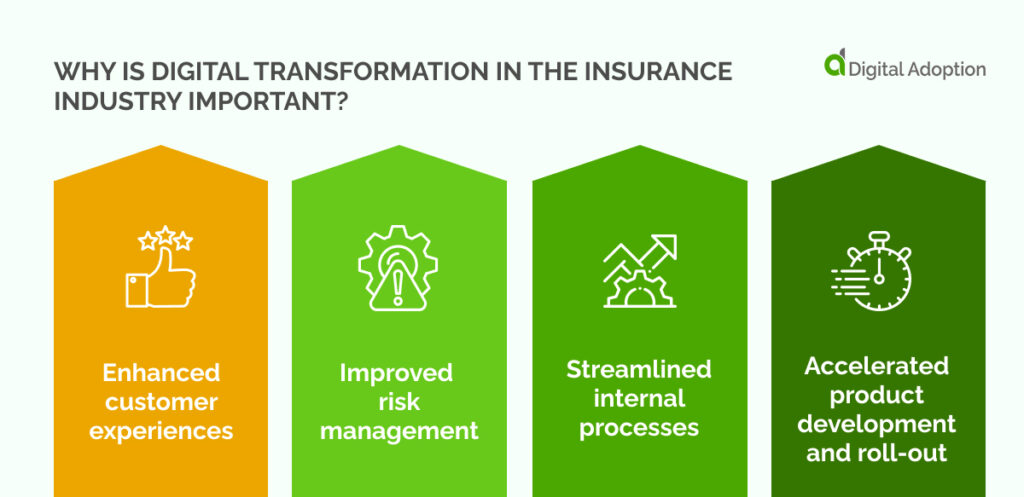

Why Is Digital Transformation In The Insurance Industry important?

Today, digital transformation is a necessity, not an option. Insurance companies that want to thrive in the current era in digital have to adapt quickly: not least because of the major investments in insurance technology. [https://www.digital-adoption.com/digital-adoption-insurance-research/]

Fortunately, there are many operational and business benefits waiting to be achieved.

Operational benefits include:

- Enhanced customer experiences

- Improved risk management

- Streamlined internal processes

- Accelerated product development and roll-out.

And for the bigger picture, this can lead to major business benefits, including:

- Increased ability to change with market demands

- Improved efficiency for all processes

- A sustainable model of growth.

In the short term, insurance companies should choose one or two goals to aim for. But in the long run, they can expect to see improvements across the benefits.

Challenges for implementing Digital Transformation in Insurance Operations

Companies must face many challenges to get the benefits of digital transformation insurance.

Of course, digital transformation is always a project in change management. Just like a restructuring, merger, or crisis management, leaders must plan for disruption and hold-ups. Specifically, those might include: getting buy-in from people; providing adequate training; monitoring digital adoption across the company; and maintaining productivity during the process.

But there are also some bigger challenges to meet in the long term. These include business models, revenue generation, and the speed of delivery.

Business Models

Digital transformation is not just about implementing new front-end technologies. To fully realize its benefits, insurance companies must rethink their entire business model, which can be long and difficult. This requires long-term planning and deciding whether to prioritize cost-cutting or growth generation.

For larger companies, it may even be necessary to spin off a new company to fully realize the benefits of digital transformation. This is because people, processes, and technology must be revised to ensure a successful transformation.

Revenue

When a company starts its strategy, they may decide to focus on cost reduction or business growth. In the long term, they can pursue both goals.

Furthermore, new technologies could actually hit revenues. For example, telemetric devices are great for consumers, but they may not be as beneficial for insurers who rely on risk to generate revenue. Therefore, insurers must carefully consider how they will continue balancing their business operations.

Overall, our own insurance research has shown that “getting digitized sooner helps to create an edge over competitors”. Even if DX only creates a small financial advantage, it could be critical in the long run.

Speed

Speed is a crucial factor in digital transformation. Insurance companies must adapt quickly to consumer tastes, behavior, and technology changes. This means that internal development teams must create and roll out changes within a few months – not years. An initial strategy should prepare for changes in the program.

Regular reviews will be necessary to stay competitive as the digital transformation goes forward. Agile organizations have a natural advantage in this area.

Implementing Digital Transformation: Insurance for the 21st century

The insurance sector is a complex and highly-regulated industry. So, it is not surprising that it has resisted change in the past. However, digital transformation is crucial to the insurance industry’s evolution. It presents many opportunities for companies to improve their operational efficiency, reduce costs, and deliver a better customer experience. To successfully implement digital transformation, insurance companies must adopt a strategic approach tailored to their business needs.

Existing companies, with their very wide expertise, have the potential to make the most out of successful digital transformation. However, they need to move fast. Smaller startups often have a digital native mindset and could reap the benefits that larger companies aren’t considering.