Few areas of technology acquisition create more uncertainty for buyers today than SaaS pricing. As a result, the software buying process often feels increasingly complex for CIOs and teams responsible for meeting shifting enterprise demands.

SaaS buyers must evaluate diverse pricing models, monitor changes in product functionality, negotiate with vendors, manage renewals, and assess financial and operational risks—all while ensuring that investments support broader digital transformation goals. Without a structured approach, SaaS spend can escalate quickly and outpace the value it is intended to deliver.

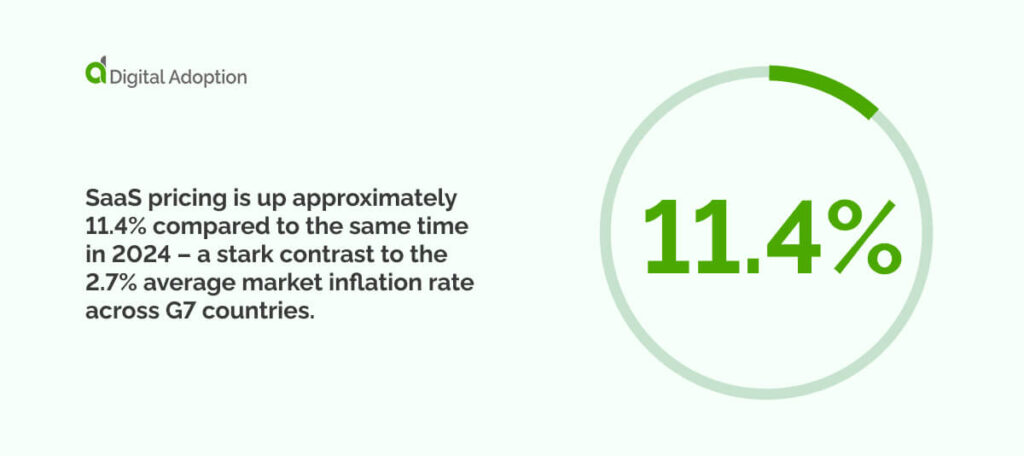

Complicating matters further, SaaS pricing is up approximately 11.4% compared to the same time in 2024 – a stark contrast to the 2.7% average market inflation rate across G7 countries. This widening gap underscores the importance of disciplined pricing evaluation and negotiation.

This article equips SaaS buyers to navigate the full pricing lifecycle, focusing on measurable levers that lead to stronger vendor outcomes and a clearer return on investment.

- Why is understanding SaaS pricing important?

- What are the different types of SaaS pricing models?

- How to identify good vs. poor value in SaaS proposals

- What methods can be used for negotiating SaaS pricing and renewal terms?

- How to calculate SaaS total cost of ownership (TCO)

- How to measure SaaS return on investment (ROI)

- How to choose the best pricing strategy for your SaaS business?

- People Also Ask

Why is understanding SaaS pricing important?

Understanding SaaS pricing ensures software investments deliver measurable value.

Without a clear grasp of pricing mechanics, organizations lose budgeting precision, misjudge vendor proposals, and accumulate applications that drain IT spend without advancing operational goals.

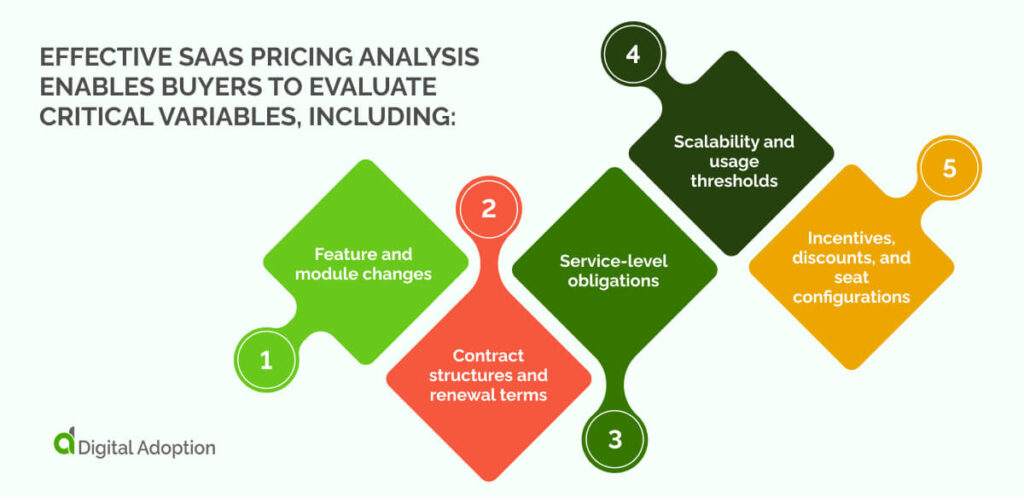

Effective SaaS pricing analysis enables buyers to evaluate critical variables, including:

- Feature and module changes

- Contract structures and renewal terms

- Service-level obligations

- Scalability and usage thresholds

- Incentives, discounts, and seat configurations

Assessing these factors strengthens lifecycle cost forecasting and sharpens ROI evaluations. It also prevents bloated portfolios built on misaligned deals that fail to support core business functions.

A well-defined pricing strategy equips buyers to refine contract scope, select only the modules and services they need, and shorten negotiation cycles.

Ultimately, understanding SaaS pricing protects financial performance, improves procurement accuracy, and mitigates buyer’s remorse.

What are the different types of SaaS pricing models?

SaaS solutions offer various pricing models that outline distinct payment processes.

For software procurers trying to balance and prioritize digital initiatives, each model will offer a different pricing structure. This includes subscription pricing or usage-based models that charge monthly or annually, or for services used.

Let’s explore the most widely used pricing models offered with modern SaaS solutions:

| SaaS Pricing Model | Model Overview |

| SaaS subscription model | Charged monthly or annually for continuous access to the service. |

| Usage-based pricing model | Pay-as-you-go structure in which metrics such as data storage, bandwidth, transactions, processing time, or compute hours determine the cost. |

| Per-user pricing | Fixed rate per active user or seat, offering predictable and manageable costs. |

| Tiered pricing model | Access is structured in tiers, with higher tiers unlocking broader feature sets. |

| Feature-based pricing model | Pricing aligns with specific features used, allowing buyers to tailor solutions to targeted product segments. |

SaaS subscription model

SaaS is primarily offered through a subscription-based, recurring model. Pricing is set and is charged on a monthly or annual basis for continuous access to the service.

Ongoing subscription pricing also eliminates the need to pay for in-house software costs after purchase, with fees of continuing maintenance, server and data storage, and tech support usually included in contract terms.

Usage-based pricing models

Usage-based pricing charges customers based on the amount of service they use. Customers enter a pay-as-you-go plan in which metrics such as data storage, bandwidth, transaction volume, processing time, or compute hours are measured. For SaaS budgets with tighter margins, this pricing structure keeps business spending aligned with user consumption.

Per user pricing

Per-user pricing charges a fixed rate for each active user or seat, making costs predictable and easy to manage. It suits stable teams with consistent headcounts but can be less efficient for projects with fluctuating user counts, where frequent employee onboarding and offboarding make costs rise and fall with changing collaboration demands.

Tiered pricing model

Tiered pricing models are common in popular applications like Spotify, Grammarly, and Trello, where service access is tiered, and feature access increases at higher price points. Tiered pricing will offer several service packages. For example, freemium, premium, or VIP models are suitable for companies of all sizes. Different price points can accommodate project needs of varying scale.

Feature-based pricing model

A feature-based pricing model charges based on the product features used, allowing buyers to configure succinct solutions for key product segments. They are akin to tier-based pricing, where key charges depend on features used. For example, integrations, AI automations, and analytics. Ideal for experimental digital adoption or business model changes at companies requiring integral parts of a solution instead of the entire package.

How to identify good vs. poor value in SaaS proposals

A key skill for software buyers and tech procurement teams is the ability to view the buying process holistically and analyze all components.

This includes a knack for recognizing the difference between a SaaS proposal that offers true value and those that deliver little beneath the shiny veneer.

Ideal SaaS propositions will:

- Enable your champion to advocate internally: SaaS investments are usually championed by individuals who motivate tool adoption. They bridge the motivations of stakeholders and the C-suite with the solution’s proposed value. Providers advocate for these champions, guiding them through deal parameters, adoption, pricing changes, and analytics until they recognize the asset value.

- Present value in a clear, shareable format: Instead of relying on vague drivers for adoption, motivate sign-offs from CIOs, chief legal officers (CLO), and CFOs with research delivered in a clean, collaborative, and comprehensive format. Terms, documentation, and deal stages should be unambiguous, with implementation data, risk factors, and financial forecasts arranged concisely.

- Maintain momentum with defined next steps: Vendors should keep deals moving and motivate customers to finalize. Ensure you outline a clear action plan from the needs assessment through implementation and onboarding. They should outline an action plan, roadmap, milestones, and owners before locking into a contract.

Bad SaaS propositions will:

- Focus on features over outcomes: Poor SaaS proposals tend to focus solely on quantifiable benefits, such as technical wins and shiny new AI features. Transformation leaders today, however, place less emphasis on the nuts and bolts of technology and more on the long-term and macro benefits these solutions offer. Vendors should research customer objectives and goals, and present tailored solutions that address a long-standing company obstacle.

- Lacks clarity on next steps: Not clarifying next steps confuses customers about which phase of the negotiation they’re in. They may be ready to progress to payment, but if no follow-up plan, no mutual action steps, no defined responsibilities are expressed, deals lose steam or risk going to another vendor. Confirming review meetings, setting deadlines, or identifying internal champions keeps both sides aligned.

- Neglects risk and objections: Vendors that overlook risk factors or business concerns. For example, data security, integration limits, or contract flexibility indicate a lack of preparedness. Strong SaaS proposals anticipate these questions upfront and address them with solutions. Bad ones avoid them entirely, leaving buyers to imagine worst-case scenarios.

What methods can be used for negotiating SaaS pricing and renewal terms?

To help inform better vendor negotiations, tech procurers can use the following methods to construct the ideal SaaS pricing structure.

Here’s a quick look at the methods for better SaaS pricing negotiations:

| Method | Priority | Objective | Essential Actions |

| Needs assessment | High | Ground negotiations in verified requirements | Define needs; benchmark vendors; use structured analysis. |

| Set measurable expectations | High | Remove pricing ambiguity | Specify all usage metrics and formalize them in the contract terms. |

| Contract flexibility | Medium | Enable scalable, penalty-free adjustments | Secure true-up/true-down rights; clarify SLAs; allow seat/usage changes. |

| Renewal & exit planning | Medium | Avoid lock-ins and strengthen leverage | Set notice periods; avoid auto-renewals; negotiate seat/usage reductions; define data-migration terms. |

| Strategic payment terms | Lower | Align spend to consumption patterns | Match payment to usage; leverage tier or annual discounts. |

Conduct a needs assessment for stronger negotiations

Conducting an organizational needs assessment before selecting your SaaS is key. Tech procurers must opt for solutions that don’t just address immediate needs but also remedy long-term ones yet to be anticipated.

Try leveraging a needs analysis tool or requirements management software to gauge organizational pain points in a data-driven way. Cleverly compiling information from an array of vendors enables more confident negotiations to set specific terms that directly address both current and prospective needs.

Target contract flexibility

Scalability goes hand in hand with flexibility for organizations testing new digital tools and adoption strategies.

Understanding how vendors scale and structure contracts that adapt to sudden changes keeps deals sustainable. Do they outline clear growth paths with updates and VIP features, or adjust service-level agreements (SLAs) as demand grows?

Negotiate contract terms that allow you to scale seats up or down without penalty. True-up and true-down rights prevent paying for unused licences as headcount or adoption shifts.

Ask specific questions such as:

- “Can we reduce seats by X% at renewal without triggering a repricing?”

- “What’s the minimum seat commitment you can support?”

Set measurable expectations

Vendors’ response to downtime, maintenance methods, or how they can guarantee operational norms should be assessed. How is support offered or escalated when issues persist? This needs to be made clear in SLAs.

Assess solution offerings, performance, and potential vendor management challenges to establish baseline expectations. Vendors often price based on seats, modules, or consumption, but the definitions are vague.

Make every metric explicit:

- What counts as an “active user”?

- When does usage reset?

- What triggers higher-tier pricing?

- How is API usage measured?

Require each usage metric to be written as a measurable formula in the contract (e.g., “active user = logged in at least once every 30 days”). This prevents surprise invoices and ensures pricing scales are predictable.

Negotiate payment terms strategically.

Accepting vendor terms of service and delivery expectations without configuring specific pricing wins for key solution segments isn’t resourceful spending.

Negotiate payment strategically by first understanding the different pricing models offered by vendors and tailoring your use to match the charges.

Are there feature enhancements or discounts for certain pricing tiers, or for annual vs. monthly payments? Securing specialised pricing for changing usage volumes gives buyers greater flexibility in payment terms and tool access.

Plan for renewal and exit

SaaS purchases are more than configuring service terms and making the purchase. It’s about considering how solutions will be continued or decommissioned, or how contracts will be exited or renewed.

Both parties need to outline termination and end-of-life clauses before entering a formal contract. Buyers need to set up exit plans that include data migration plans and the required timeframes for the transition.

Additionally, swift contract renewal and exit terms should aim to:

- Secure renewal windows and extended notice periods to avoid auto-renewals and create leverage during renewal discussions.

- Negotiate the right to scale seats or usage down at renewal without penalty, preventing forced over-commitment and strengthening your position in pricing talks.

How to calculate SaaS total cost of ownership (TCO)

Figuring out the total cost of ownership (TCO) is an important part of SaaS pricing considerations.

SaaS costs go beyond acquisition costs and include various indirect and ongoing expenses that may not be initially considered. Finance and IT leaders need to assess the TCO of an SaaS asset. Once that is done, an accurate picture of software ROI can begin to appear.

Identify all direct costs.

Direct costs are the initial, up-front payments for SaaS procurement, including the first subscription, service setup, onboarding, and implementation costs.

These costs are immediate and identifiable in the contract documentation, helping buyers understand what they need to invest in. Calculating these costs is the first step in understanding the TCO.

Include indirect and hidden expenses.

Calculating the indirect, ongoing, and overlooked costs of an SaaS solution is necessary to get a more accurate financial outlook post-deployment.

These are the costs of everything else post-purchase, primarily operating and maintaining the service throughout its lifecycle.

This includes anticipating digital adoption platform pricing during user adoption, data migration costs, and vendor management software costs. Without an understanding of these indirect expenses, forecasting IT spend is weakened, and there’s little way to determine whether the total cost of solutions outweighs the value they generate.

Account for variable or usage-based fees

Usage-based fees, unlike flat-rate or predictable user bases, can scale dramatically if one or two tools are being over- or underutilized.

If teams use a usage-based project management software for things other than PM, e.g., instant messaging, it can lead to unnecessary costs. Business apps are designed for specific tasks. When users fail to use the intended tool, it increases the overhead that was never accounted for.

Add security and integration costs.

Vendors handle encryption and certifications, but buyers still face costs to manage identity systems, run audits, and keep their setup compliant with standards like GDPR or SOC 2 across their own tools and environments.

Identify the security tasks you still own, estimating the internal effort to maintain them, and assigning clear costs to access governance, compliance reviews, testing, and integration hardening.

Model scalability and exit plans

Setting up contract terminations and scaling investments isn’t just a key part of contract negotiations but also TCO.

As mentioned, there are costs associated with exiting contracts prematurely if vendor solutions no longer fit or service delivery levels are breached. This also includes additional costs to transition data and deintegrate tools–account for this.

However, room to grow with SaaS will also mean accounting for expenses such as additional seats and licenses, higher data volumes, and expanded feature and support needs.

How to measure SaaS return on investment (ROI)

Once the TCO has been calculated, the financial figures can be weighted against the value generated by your SaaS to determine whether investments have produced net gains or losses.

Identify quantifiable benefits

Quantifiable benefits are value markers that can be measured in data-driven ways. It could mean a faster rate of task completion after adopting a digital adoption platform (DAP), or an increase in sales after using an automated out-reach and follow-up tool.

Statistics on improved service delivery or faster customer responses directly attributable to SaaS implementation can tell you whether it’s delivering ROI.

Estimate productivity and efficiency gains.

The flexibility and scalability of SaaS enable organizations to ramp up productivity and efficiency. Checking that your SaaS solution is working towards this goal through real metrics is essential.

Check for process improvements that reinforced operational norms as a result of your solution. This includes looking at tangible indicators: how it’s optimizing workflows, lowering time to project completion, or automating risk detection and resource allocation.

Calculate net savings and payback period.

Inspecting Software ROI also includes calculating net savings, which are derived by subtracting total ownership costs from realized financial and operational benefits.

The payback period measures how long it takes for these savings to offset initial investments, providing a concrete timeline for achieving positive ROI.

Compare TCO against value delivered.

Comparing the TCO against the value your solution has actually delivered determines whether the costs of using the software across the end-to-end lifecycle are less than the financial and operational gains over the same period.

This checks the sustainability of the solution and whether investment decisions reflect genuine value rather than simply minimizing short-term costs.

Run ROI sensitivity and scenario analyses.

Test different situations to see how the ROI changes. For example, what happens if only half the team uses the tool regularly, or if the vendor raises prices? Running these “what if” scenarios helps you view a range of possible ROI outcomes before committing long-term.

How to choose the best pricing strategy for your SaaS business?

The multifaceted aims of business rarely require a one-size-fits-all solution. Different teams, time zones, and operational priorities demand pricing structures that reflect how organizations actually work.

This makes getting the best pricing for your SaaS solution critical. The right SaaS pricing decision starts with understanding total cost and ends with negotiating terms that scale fairly.

Vendor lock-in, hidden costs, and messy legal disputes can derail even well-planned projects. Gartner reports that 80% of tech buyers feel some level of regret after buying. In cases with the highest regret, 89% had teams whose goals didn’t align.

Buyers who prioritize value over cost, question assumptions, and model long-term scenarios can make more sustainable investments that reinforce the bottom line rather than undermine it.

People Also Ask

-

What is the difference between traditional software pricing and SaaS subscription pricing?Traditional software is bought once and often needs IT to manage updates and support. SaaS uses a subscription fee, usually monthly or yearly. This fee covers updates, support, and cloud storage. It makes costs easier to predict and lets companies add users or features quickly.

-

How can businesses adjust SaaS pricing with AI-driven features?AI features make software smarter, such as automating tasks or providing insights. Companies can charge extra for these features. Using feature-based or tiered pricing shows the added value and helps earn more revenue without changing the base price.

-

How does customer lifetime value influence SaaS pricing decisions?Customer lifetime value (CLV) is the total revenue a customer generates over time. Higher CLV allows companies to invest more in getting customers. It also lets them offer flexible pricing, such as discounts, premium options, or pay-as-you-go plans, ensuring the business stays profitable in the long term.