Property and casualty insurance is a highly-competitive industry. To stay ahead of the competition, insurance providers are embracing digital transformation. They’re improving the way they do business through artificial intelligence, digital communication, and data management capabilities.

Understanding insurance digital transformation trends are crucial for thriving in this business. This article takes a close look at digital transformation in the P&C industry.

We’ll explore how new technologies lead to better customer experiences and increased employee productivity. We’ll explain why digital transformation is so important, including digital adoption best practices. And to show how transformative digitalization can be, we’ll examine leading business use cases of digital disruption in the P&C industry.

- What Is P&C Insurance Digital Transformation?

- What Does P&C Stand For in Insurance?

- The Benefits Of Digital Transformation in P&C Insurance

- Reduction In Spending For P&C Insurance Companies

- How Digital Technology is Transforming the Insurance Industry

- How Does Digital Disruption Affect the Insurance Industry?

- What is P&C data?

- Digital Transformation Trends For P&C Insurance In 2022

- 5 Use Cases Of Digital Disruption In The P&C Industry

- Prepare for the Future of Insurance

What Is P&C Insurance Digital Transformation?

Digital transformation is the process of implementing digital technology within an organization. Businesses adopt new technology to improve efficiency, boost employee productivity and offer more value to customers. Many insurance companies are undertaking a digital transformation to gain a competitive advantage and provide usage-based insurance.

The insurance sector is constantly changing due to evolving customer expectations. People are buying their first home or car at an older age. Customers expect a more personalized experience when interacting with an insurance company.

Achieving customer satisfaction in a digital landscape means embracing digital technologies to create a customer-centric insurance business. Offering usage-based insurance for the modern customer is only possible through digital transformation.

What Does P&C Stand For in Insurance?

Property and Casualty insurance (P&C) protects the things you own, such as your home, car, and pets. P&C is an umbrella term for insurance that covers your personal belongings and offers liability coverage for each policy.

Property insurance is especially important for business owners. It protects your business and its contents in the case of theft or vandalism. The coverage helps business owners recover the cost of lost or damaged goods.

Casualty cover includes any insurance that covers legal responsibility for an accident that causes damage or injury to a person or their property. Business owners use the policy to cover liability for accidents in the workplace.

The Benefits Of Digital Transformation in P&C Insurance

How can digital transformation improve your insurance company? Many providers are undergoing massive transformation initiatives to take their business to new heights. Digital technologies have proven effective in enhancing all areas of an organization.

Let’s look at the benefits of digital transformation in P&C insurance.

Heightened Customer Experience For Policyholders

Insurance carriers must embody a customer-centric business model if they want to meet their policyholders’ expectations. The best way to enhance the customer experience is through digital transformation.

Artificial intelligence standardizes claims calculations, making claims processing faster and more transparent. Improving data management capabilities allows insurers to offer customers lower premiums.

Consumers also prefer having all their information on one digital platform. A recent McKinsey report shows, ‘ After purchasing a vehicle, 39% of all buyers want to activate additional digital services.’ Customers want to access their mobile devices’ information on quotes, loss assessment, and claims management.

Technology solutions change how customers and businesses interact, making it easier for insurance services to attract new customers and build brand loyalty.

Reduction In Spending For P&C Insurance Companies

Digital transformation initiatives reduce operating costs by increasing efficiency across an organization. A company has several directions to achieve this, but the end goal is to simplify business processes.

Take customer service, for example. Insurance services dedicate much time and money to support staff when customers call. Digitalization offers an alternative business model.

Insurance companies can offer an online service to meet customer needs and streamline the customer journey, reducing costs in the process.

Online self-service platforms make it easier for customers to get help from the convenience of their smart devices. This also means companies can direct resources to other areas of the business.

Increased Scalability

When a company improves its digital capabilities, it can start to scale up faster. Digital transformation leads to lower costs and more efficient business processes, meaning a business can reach more customers.

In times of disaster, policyholders need help processing claims as quickly as possible. Digital platforms provide immediate assistance; in the future, customers know they can rely on their provider.

Digital transformation creates a transparent value chain from business to customer. Maximum efficiency leads to cost-effective business practices, better business outcomes, and the opportunity to scale up.

Reduced Risk & Fraud Prevention

P&C insurance providers use cutting-edge technologies to assess risks accurately. They monitor customer activity through their devices and use this customer insight to offer a personalized insurance policy.

For example, a provider can use data on a driver’s activity to process claims filings for vehicle insurance. As a bonus, insurance analytics encourage safe driving behavior and leads to fewer accidents.

Insurance companies can also improve fraud detection using the same process. When customers file a claim, they cross-check available data to identify their risk level.

Enhanced data management means there are so many data points a provider can use to assess actual risk and efficiently settle claims.

How Digital Technology is Transforming the Insurance Industry

Achieving business growth in the digital era means adapting to the demands of a digital-first consumer base.

Digital marketing leaders drive digital transformation in the insurance industry to optimize the buyer journey. Customers expect a multichannel buying experience and a quick and easy-to-use self-service platform.

Microsoft’s report on the ‘State of Global Customer Service’ discovered that 90% of customers expect brands to have an online self-service support portal.

Digital technology is also helping the insurance industry adopt a ‘predict and prevent’ insurance model. Improved data sharing capabilities allow insurers to assess risk and effectively prevent claims.

How Does Digital Disruption Affect the Insurance Industry?

Digital disruption occurs when digital technologies create new business models and change how customers interact with companies. Businesses must respond to changes in the culture and market to meet new customer expectations.

In the past decade, other industries have experienced immense disruption, but how has digital disruption affected insurance?

Gartner’s report on meeting the needs of the new generation of insurance consumers suggests that ‘Insurance CMOs face increasing competition with direct-to-consumer (DTC) carriers.’

The rise of self-service platforms has disrupted the customer-insurer relationship. An increasing number of customers prefer to self-manage their information online.

Digital platforms also create consistency across multiple contact points, strengthening the brand image. They act as an easy-access knowledge base for customers to find solutions to their problems.

What is P&C data?

P&C insurance covers the risk of property damage. For example, home insurance protects owners in case of damage from fire, weather, or losses from theft. Policies might include more specific cover, such as fire cover.

Because there are so many data points to consider in insurance, providers require big data capabilities. Insurance carriers are prioritizing deep tech expertise and comprehensive data architecture to support their organization.

Digital Transformation Trends For P&C Insurance In 2022

To stay ahead of the competition, insurance companies must embrace the following digital transformation trends for 2022.

Conversational AI

COVID-19 led to an increase in chatbots for customer support across many industries. P&C insurance executives are taking advantage of the trend by investing in conversational AI technology to enhance customer service.

Customers are now familiar with chatbots and virtual assistants to help them with simple tasks. But conversational AI isn’t here to replace the workforce. Instead, insurers employ AI to deal with the most repetitive tasks, so human staff is free to help customers with more complicated problems.

Machine Learning

Insurance carriers have access to more data sources than ever before, including online activity, telematics, wearable devices, and connected sensors. Machine learning technology uses this wealth of data to produce analytical insights.

Ml technologies can also analyze claims report data to generate templates to improve claim processing in the future. Predictive learning models give insurers a competitive edge by enhancing their business operations.

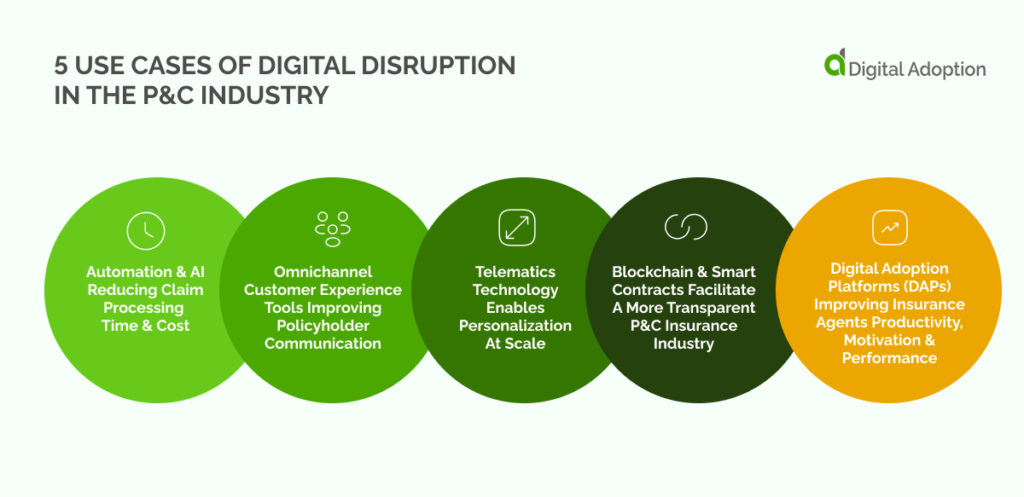

5 Use Cases Of Digital Disruption In The P&C Industry

In order to align with the evolving demands of customers, insurance businesses are investing in digital assets. Insurance business leaders understand the importance of preparation when overcoming digital disruption.

Here are five use cases of digital disruption in the P&C industry. They represent the best practices in responding to changes in a digital landscape.

Automation & AI Reducing Claim Processing Time & Cost

The rise in automation and AI in insurance has fundamentally changed how customers interact with insurers. Policyholders are less likely to call up and instead look to digital platforms to get what they need from their insurer.

To meet these demands, the P&C insurance industry is investing in automation and AI to improve its services. Automated claims processing systems allow customers to process claims 24/7 at a time that suits them. Online support such as chatbots offers convenient support for busy customers.

Overall, automation and AI reduce the burden on support and claims processing departments, meaning insurance companies can save costs on staff.

Omnichannel Customer Experience Tools Improving Policyholder Communication

As more insurers try to sell more products online, they are turning to omnichannel tools to streamline the customer experience. The goal is to connect with customers across multiple channels within one system.

To gain a competitive edge, insurers must take a user-first approach to communication. An omnichannel customer experience involves three main components:

Online-purchasing capabilities

The insurance industry as a whole still relies on face-to-face sales, but an increasing number of products get sold online. Companies have a long way to go to digitize their business models and meet the needs of tech-familiar consumers.

Easy navigation of digital platforms

This comes down to the quality of the insurer’s website and how they design the product journey. Insurance companies are working to simplify navigation and shorten the journey from the landing page to product purchasing.

Integration of support services

The majority of customers research policies online and purchase insurance products in person. To encourage online purchasing, carriers can integrate their digital and non-digital channels. Omnichannel tools give customer service agents better insight into each customer, improving their ability to answer queries.

Telematics Technology Enables Personalization At Scale

Telematics comes under the umbrella of the Internet of Things (IoT) technology. IoT refers to a network of interconnected devices that can exchange data over communication networks such as the internet.

Insurers are embracing the potential of increased information flow to offer customers personalized insurance products. Insurers can use data captured from wearable devices such as a Fitbit or cell phone to determine a policyholder’s risk accurately.

For example, telematics can analyze a policyholder’s driving activity to assess their level of risk. If a driver is regularly speeding or driving late at night or in the morning, insurers have the right to raise premiums. On the flip side, safe drivers get rewarded with lower premiums.

Insurance companies also utilize telematics to personalize dwelling coverage for their policyholders by working with utility services. Utility partnerships provide energy consumption data and customer usage patterns so an insurer can enhance pricing liability.

Blockchain & Smart Contracts Facilitate A More Transparent P&C Insurance Industry

Insurers are incorporating technologies like blockchain to develop their IT infrastructure and improve their services. More companies are shifting to smart contract processes rooted in blockchain technology for greater security and more effective fraud prevention.

A smart contract is an insurance contract that pays out automatically when specific, predetermined conditions are met. For example, a policyholder’s device detects an event such as a flood or earthquake, which the smart contract covers, and the system can automatically payout.

You can settle smart contracts on the blockchain in a decentralized environment, meaning no one can interfere with the contract. The lack of human interference offers more transparency.

Smart contracts offer increased transparency because there are no third parties involved. This also means insurers save money on administration costs and experts believe this technology could save insurers up to $10 billion in the future.

Digital Adoption Platforms (DAPs) Improving Insurance Agents Productivity, Motivation & Performance.

Introducing new software is a great way to improve business processes, but training staff to use new systems can be challenging. That’s why many companies undergoing digital transformation opt to use a digital adoption platform.

A digital adoption platform (DAP) is software that ensures proper training for staff on digital assets. DAPS integrates with a software system to guide employees through the learning process.

A digital adoption platform tailors training to an individual, meaning insurance agents can learn a new system at their own pace. Providing comprehensive training and support is crucial to encouraging engagement in new software.

Remember, successful digital adoption boosts employee productivity and performance.

Prepare for the Future of Insurance

By now, you should clearly understand how digital transformation is transforming the insurance industry. Digitalization leads to more efficiency, scalability, and agility for insurance companies.

But this is just the beginning. The future is undeniably digital. To prepare, the insurance industry needs to learn digital transformation tools. Adopting technology is more about creating a digital-friendly company than investing in the best tech.

Technology can potentially improve business processes and enhance services for the policyholders. Future technology applications might be hard to imagine, but they will arrive quickly, and customers expect their providers to respond.

Without a consistent and comprehensive digital transformation strategy, a business won’t know how to respond to change effectively. Embrace digital transformation today to prepare for a digital future.