Artificial intelligence (AI) adoption in insurance is still a relatively new development.

However, it’s already being used in all manner of ingenious ways, from evaluating claims faster and more accurately to designing new policies that reflect divergent market demands.

What began as experimental use cases is now evolving into something more impactful. There is a renewed push to reimagine the insurance industry with AI, building on the strong digital foundations already in place.

As pressure grows to stay competitive and meet rising customer discovery expectations, the sector is primed for large-scale digital transformation.

From enhancing policy personalization and claims intelligence to optimizing operations, this article showcases 16 AI in insurance examples upending practices in the field.

AI in insurance examples at a glance:

| AI Technology | Function | Category |

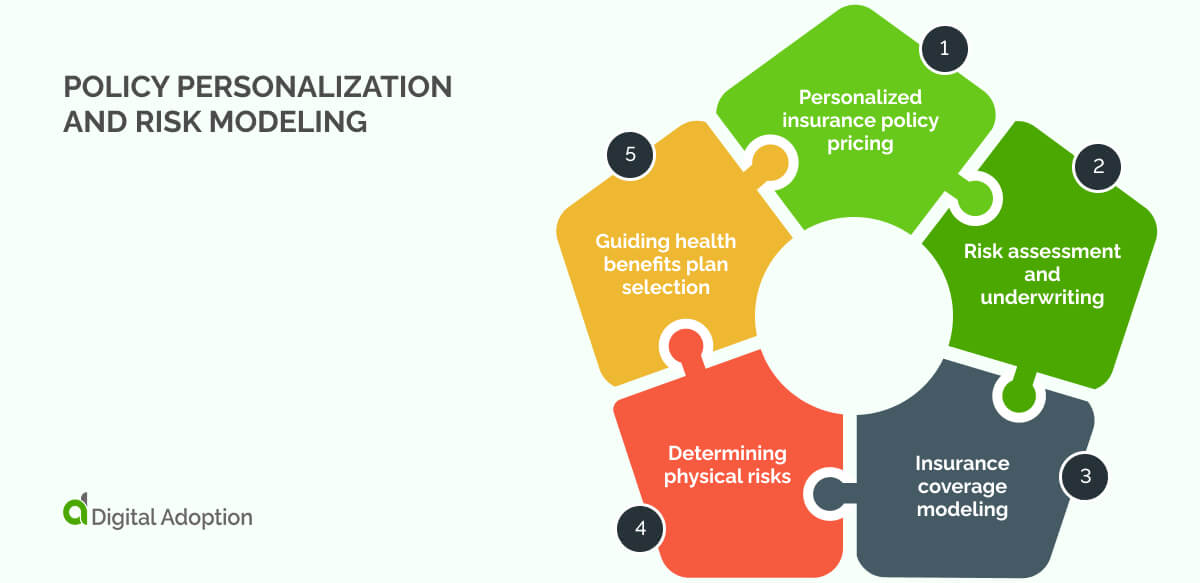

| Personalized insurance policy pricing | Sets insurance prices based on your habits and history. | Policy personalization and risk modeling |

| Risk assessment and underwriting | Checks your information to determine if you are eligible for insurance and at what cost. | Policy personalization and risk modeling |

| Insurance coverage modeling | Test different coverage options to find the best fit for you. | Policy personalization and risk modeling |

| Determining physical risks | Examine the weather and location to identify potential risks that may impact your insurance. | Policy personalization and risk modeling |

| Guiding health benefits plan selection | Helps pick the best health plan based on your needs and medical info. | Policy personalization and risk modeling |

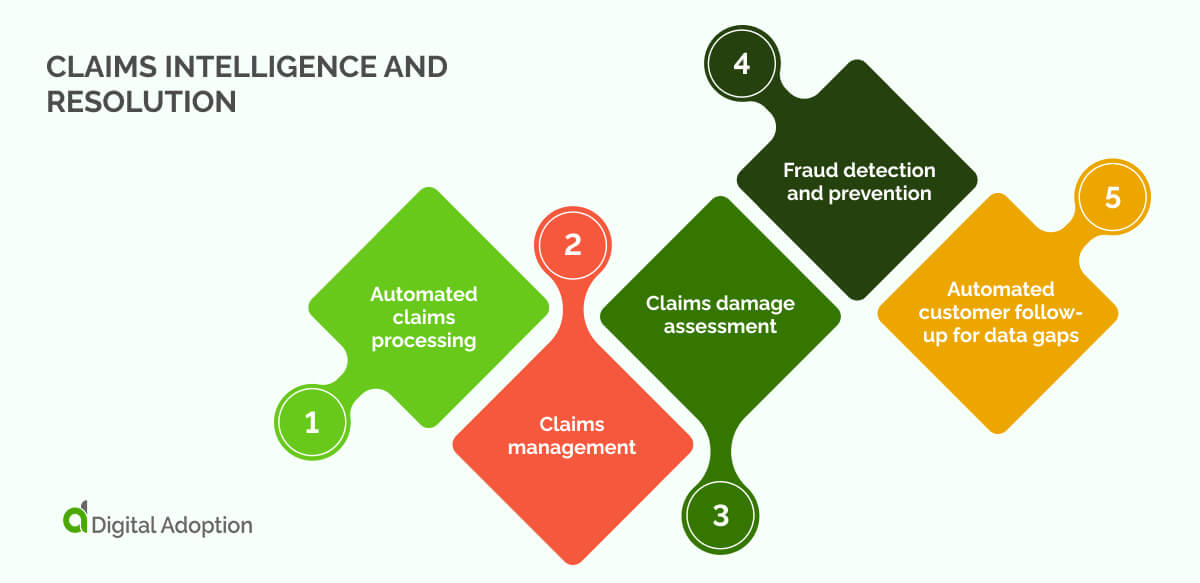

| Automated claims processing | Reads your claim papers and expedites the approval process. | Claims intelligence and resolution |

| Claims management | Keeps track of your claim and handles problems to speed things up. | Claims intelligence and resolution |

| Claims damage assessment | Looks at photos of damage to figure out repair costs. | Claims intelligence and resolution |

| Fraud detection and prevention | Spots fake claims by comparing them to known fraud patterns. | Claims intelligence and resolution |

| Automated customer follow-up for data gaps | Reminds you if you forget to send any claim documents. | Claims intelligence and resolution |

| Customer service chatbots | Answers common questions anytime without waiting. | Customer experience and engagement |

| AI-based customer journey guidance | Suggests products and services based on what you need or want. | Customer experience and engagement |

| Business process automation | Does routine tasks like paperwork automatically. | Operational optimization and innovation |

| Predictive analytics | Uses past data to guess future claims or customer actions. | Operational optimization and innovation |

| Code modernization | Finds old computer systems and suggests updates. | Operational optimization and innovation |

| New product development | Tests ideas to create new insurance products. | Operational optimization and innovation |

Policy personalization and risk modeling

Our first category focuses on AI examples that utilize personal data to fine-tune and adjust policy parameters in response to changing real-world conditions.

This data is also used for modeling and forecasting external risks, such as cyberattacks or natural disasters.

Personalized insurance policy pricing

Life insurance companies usually decide prices based on fixed details like your age, where you live, your health, and if you’re married. These monikers help them determine how much risk is involved and what kind of payout they might receive.

AI is changing this by making policy pricing more flexible. It can adjust prices and payouts over time as your situation changes.

With your permission, AI uses data from things like fitness watches or smart devices to better understand your lifestyle and offer a plan that fits you personally.

Risk assessment and underwriting

As mentioned, insurance policy terms are mainly based on measuring risk—the greater the risk, the higher the premium. Getting these risk assessments right is crucial, as they can heavily impact how much someone pays or receives from a policy.

Manual processes, like reviewing documents and weighing risk factors, can be time-consuming and difficult for underwriters.

With AI, machine learning (ML) algorithms can quickly analyze many data sources at once. For example, they might use satellite images, weather forecasts, and drone footage to assess coverage for a solar energy project.

Insurance coverage modeling

When it comes to policy structuring, traditional coverage models are based on assumptions from past data, trend averages, and fixed risk groups.

Relying only on historical and statistical data to decide coverage no longer works for fast-changing and complex events. AI changes this by making coverage models more flexible and able to adjust as conditions change.

Determining physical risks

AI is becoming increasingly adept at assessing physical risks. Traditional inspections and infrastructure audits rely on human judgment, large datasets, and informed guesswork. AI shifts this by using the processing power of data centers to monitor their own lifecycle.

In data center insurance, AI draws from IoT-connected sensors to track heat levels, server cooling, airflow, and greenhouse gas emissions. These inputs let AI evaluate digital infrastructure risk as it evolves. Earlier models assessed risk based on site location or structural age. Now, AI identifies real-time vulnerabilities.

If AI detects faults in cooling or electrical systems, it can recommend early maintenance. Improved metrics may lower premiums and recalibrate the risk score immediately.

Guiding health benefits plan selection

Traditional health risk models rely on fixed assessments. A patient’s condition might appear stable one day, then decline the next, with no update to their insurance plan. Static evaluations often miss unforeseen changes, leading to plans that either offer too much coverage or fall short when needed.

AI presents a chance to match patients to the right coverage. It considers lab results, sensor data, doctor notes, and medication patterns. It compares sudden or irregular changes in health against established norms, weighing risk trends rather than just observing static snapshots at a single point in time.

Adequate and accurate insurance will improve care and protect those whose conditions shift unexpectedly.

Claims Intelligence and resolution

This category covers AI in insurance examples focused on claims intelligence and resolution.

It replaces long-standing, siloed digital workflows with proactive systems for efficiently managing claims.

Automated claims processing

AI-automated claims processing supports human reviewers by scanning reports as soon as they arrive. It checks policy terms, past claims, and payout averages for similar cases.

Reviewers can hand off routine tasks to AI. This includes reading paper or digital text, verifying damage through image recognition, and utilizing external data to confirm details.

AI can recognize patterns often missed by the human eye, helping to avoid mistakes caused by rushed or tired reviewers.

Claims management

Traditional claims management moves slowly because it treats every case the same. Fixed steps, repeated checks, and long waits stretch even simple claims into drawn-out processes.

Adjusters often piece together details from different sources, which makes delays harder to avoid.

AI changes that by reading each claim in context. It connects written descriptions to policy terms, reads images as evidence, and compares new claims to past ones. It checks external data to see if events align.

That way, only uncertain cases get held up and must move forward without friction.

Claims damage assessment

Claims damage assessment traditionally depends on in-person inspections and photo reviews, which can be slow and inconsistent.

Adjusters interpret images and reports based on their experience, often without having the full context. This leads to estimates that are skewed in favor of the adjuster’s opinion, potentially causing delays.

AI changes the way damage is evaluated by analyzing photos with computer vision and comparing them to historical cases. It factors in repair costs, materials, and regional price differences.

The system weighs each element together, offering a balanced view that supports faster, more consistent assessments without losing nuance.

Fraud detection and prevention

Detecting insurance fraud relies on careful claims examinations and observing past patterns, which can sometimes overlook new or subtle schemes and wrongly flag honest claims.

Investigators analyze reports and conversations, a slow process prone to mistakes.

AI examines language in claims, picking up unusual or contradictory wording that humans might miss. It also sees small connections across claimants, providers, and events. This enables it to recognize suspicious claims more accurately while allowing genuine ones to proceed without delay.

Benefits are realized through quicker and more accurate fraud detection, with fewer false alarms.

Automated customer follow-up for data gaps

Some claims get held up because claimants don’t declare missing details. The process relies on staff determining what’s incomplete, which doesn’t always happen in a timely manner.

AI reviews incoming claims as they arrive, using intelligent document processing (IDP) and image recognition to check for gaps based on claim type, policy terms, and past submission patterns. If information is missing, it writes a clear message and chooses the best way to contact claimants.

It also automates follow-up reminders if replies don’t come in, keeping the process proactive and bridging delay gaps.

Customer experience and engagement

This next category highlights AI tools that enhance claimant interaction and support, as well as technologies that facilitate navigation and understanding of policy details.

It’s essential to note that these tools don’t replace human support, but rather augment it, providing faster responses, clearer communication, and more personalized guidance throughout the insurance journey.

Customer service chatbots

Claims management means customer service teams often rely on scripts and shared inboxes to handle new claims, claimant queries, and other customer-facing requests. This slows down response times and lengthens wait times, as resolving requests takes far longer than necessary.

AI chatbots for customer service help augment the customer experience (CX), employing natural language processing tools to understand and interpret what customers say.

The system picks up patterns from past chat memory to deliver intuitive and contextual replies. It can also ask follow-up questions, process new claims, and, if needed, pass complex queries to a human agent when the request falls outside its training.

AI-based customer journey guidance

Insurance customers often struggle with complex policies and the claim process. Traditional tools rely on fixed scripts or general FAQs that don’t fit every situation.

AI now uses language understanding to grasp what the customer really needs. It links together details, such as past questions and policy terms, to guide each person with clear steps.

The system balances these pieces of information to offer tailored advice. This lowers hassle and keeps the process moving without constant human help.

Operational optimization and innovation

This final category focuses on how insurers are rethinking operations and unlocking new value.

Legacy processes are being streamlined, freeing teams to focus on higher-impact work. At the same time, innovation is accelerating, driven by deeper insights, dynamic risk models, and faster product cycles.

Business process automation

Insurance companies spend a lot of time on repetitive tasks like claims processing and data entry.

Business process automation streamlines these tasks and reduces errors, making insurance sales operations more efficient and effective. This allows employees to focus on more complex problems, thereby improving service quality.

As a result, automation helps insurers respond faster to customer insights and changes in the market, creating more efficient and effective business processes.

Predictive analytics and maintenance

Predictive maintenance and analytics use data to guess what might happen next, helping insurance companies act before issues arise.

Instead of reacting to past events, insurers can spot risks early, detect fraud, and better understand customer needs. This leads to smarter pricing and policies tailored to individuals, often resulting in more sales.

Planning ahead means companies build stronger and more reliable insurance solutions in a constantly changing environment.

Code modernization

Many insurance companies still use outdated programs with no software integration which hinders productivity and limits growth. Updating or rewriting this old code with modern technology makes systems faster, safer, and more flexible.

It also helps different tools work in harmony and allows quick adaptation to market changes.

Modernizing code is crucial for insurers to remain competitive and prevent issues arising from outdated, inefficient systems.

New product development

Insurance companies need to create new products quickly to keep up with evolving customer needs and regulations.

This requires teamwork and a deep understanding of what customers want. Studying data and market trends lets companies design policies that are relevant and easy to understand.

A fast and flexible approach to product development enables insurers to capitalize on opportunities for product-led growth and building digital trust with customers.

How will AI impact the insurance landscape in the future?

We’ve explored a wide range of AI examples in insurance to give you a clear, well-rounded view of the industry at large.

Looking ahead, AI is set to drive major change across the sector, from how insurers handle claims to how they meet rising customer loyalty expectations.

A key focus will be using AI to support secure, ethical, and reliable outcomes. This means insurers must invest in smarter digital tools and in stronger governance.

While many insurers are still in early testing phases, the next decade will see rapid growth, smarter systems, and greater value delivered across the board.

People Also Ask

-

In what ways can insurance claim investigators integrate AI into their daily tasks?AI can help claim investigators by speeding up document reviews, spotting fraud patterns, and analyzing images for damage. It also highlights unusual claims for further inspection. With these tools handling routine tasks, investigators can spend more time on decisions that require human insight and experience.

-

What potential risks arise from implementing AI within the insurance sector?Poor-quality data or flawed models can lead to unfair decisions, pricing errors, or missed fraud. Bias and lack of transparency may also affect customer trust. Insurers must regularly review systems to ensure fairness, accuracy, and compliance with legal and ethical standards across all parts of the business.

-

What major security challenge does AI introduce to insurance systems?Handling large amounts of personal data makes these systems attractive to cybercriminals. Strong safeguards are needed to prevent misuse, data leaks, or system manipulation. The challenge lies in keeping technology secure while ensuring systems remain fair, explainable, and aligned with strict data privacy regulations.

FACT CHECKED

FACT CHECKED![16 Examples of AI in insurance [2025]](https://www.digital-adoption.com/wp-content/uploads/sites/11/2025/07/16-Examples-of-AI-in-insurance-2025.jpg)