Enterprise Value (EV) is a core metric in corporate finance that captures the total value of a business, including both its equity and debt, offering a more complete picture than market cap alone. Whether a company is preparing for an IPO, exploring a merger, or undergoing digital transformation, EV plays a critical role in evaluating opportunities and risks.

By accounting for elements like outstanding debt, cash reserves, and minority interest, EV provides a valuation grounded in reality—what a buyer would pay to take over operations. It’s widely used in everything from bond issuance and joint ventures to portfolio analysis and strategic planning.

In this article, we’ll discuss how enterprise value is calculated, how it compares to other valuation metrics, such as the price-to-earnings ratio and market capitalization, and when it might fall short as a standalone indicator.

- What is enterprise value (EV)?

- What is an enterprise value (EV) formula?

- What are the components involved in enterprise value (EV)?

- How do you calculate enterprise value (EV)?

- Example of enterprise value

- Who can benefit from using the enterprise value formula?

- Why does enterprise value (EV) matter for businesses?

- How to calculate enterprise value (EV) multiples

- What are the limitations of enterprise value (EV)?

- Next steps for enterprise value

- People Also Ask

What is enterprise value (EV)?

Enterprise value (EV) is a measure of a company’s total value, often viewed as the true cost of acquiring the entire business. It combines market capitalization (the value of a company’s shares) with total debt, then subtracts cash and cash equivalents.

EV reflects the total amount a buyer would need to pay to take over a company—covering both its equity and its obligations to lenders, while also factoring in any accessible cash that reduces the net cost.

Because a buyer inherits a company’s debts and also gains control of its cash, enterprise value adjusts for both. This makes it a more complete valuation metric than market cap alone, especially when comparing companies with different capital structures.

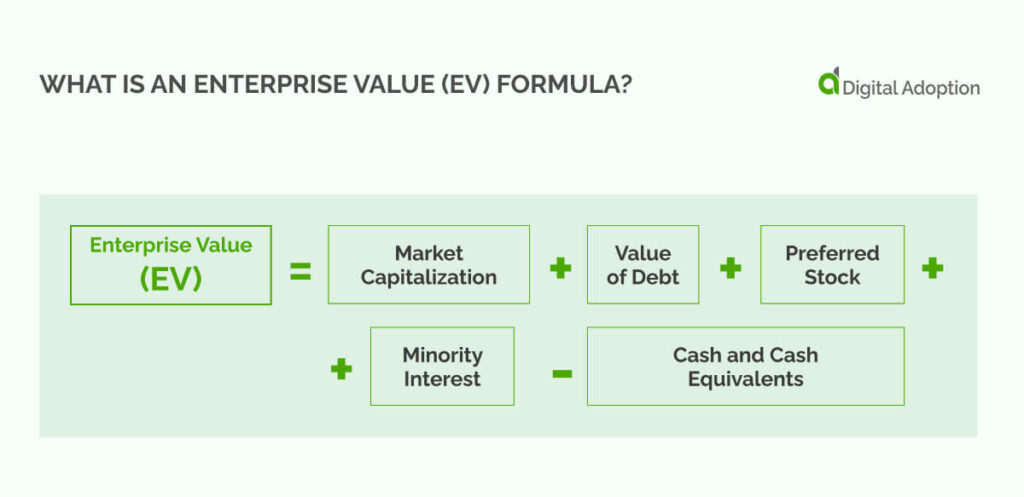

What is an enterprise value (EV) formula?

A company’s enterprise value (EV) gives an investor a clear picture of the total cost required to acquire the business entirely and represents the full price for a takeover.

To calculate this, you can use the enterprise value formula:

| Component | Formula | Description |

| Market Capitalization | Outstanding shares x share price | Total value of the company’s equity. |

| +Value of Debt | Total debt (short-term + long-term) | Total value of the company’s debt obligations. |

| +Preferred Stock | Value of preferred stock | Value of the company’s preferred stock. |

| +Minority Interest | The portion of the subsidiary owned by a minority | Value of the portion of subsidiaries not owned by the company. |

| – Cash and Equivalents | Cash & cash equivalents held by the company | Value of the company’s liquid assets. |

| = Enterprise Value (EV) | Market capitalization + debt + preferred stock + minority interest – cash and equivalents | Total value of the company, available for acquisition. |

This formula calculates the value needed to acquire a company, considering debt and cash adjustments.

The extended EV formula includes non-operating assets and provides a fuller picture of the company’s value for acquisition:

| Component | Amount (in $ millions) |

| Market Capitalization | 500 |

| + Debt | 200 |

| + Preferred Stock | 50 |

| + Minority Interest | 30 |

| + Non-Operating Assets | 40 |

| – Cash and Equivalents | 100 |

| = Enterprise Value (EV) | 720 |

What are the components involved in enterprise value (EV)?

Understanding the main components involved in enterprise value is crucial because they help determine the total cost of acquiring a company, factoring in its market value and financial obligations.

Let’s take a closer look at the main components of enterprise value:

Market capitalization

Market capitalization reflects the total value of a company’s publicly traded shares, both common and preferred. It is calculated by multiplying the current share price by the total number of shares. This metric gives investors an immediate sense of how the market values a company’s equity.

Value of debt

The value of debt includes both long-term and short-term financial obligations a company owes. This figure accounts for loans, bonds, and other forms of debt. Understanding the full extent of a company’s liabilities helps assess the financial risk and overall cost of acquiring the business.

Preferred stock

Preferred stock is a class of shares that gives holders priority over common stockholders for dividend payments. While they don’t typically offer voting rights, preferred stockholders receive a fixed dividend before any common dividends are paid, making them a more stable investment option.

Minority interest

Minority interest reflects the value of a subsidiary in which a company owns less than a controlling 50% stake. This component is important when assessing a company’s overall value, as it indicates ownership in businesses the company does not fully control, affecting the financial consolidation of the group.

Unfunded pension liabilities

Unfunded pension liabilities show how much money a company needs to set aside to meet its future pension obligations. If the company hasn’t already saved enough, this shortfall is important to consider when calculating the total cost to acquire the company. It can be added to the market value.

Cash and cash equivalents

Cash and cash equivalents include money that can quickly be turned into cash, like government bonds or short-term investments. Since buying a company means gaining access to its cash reserves, this amount is subtracted from the enterprise value to calculate the actual acquisition cost.

How do you calculate enterprise value (EV)?

The enterprise value (EV) formula is calculated as follows:

EV = Market Cap + Total Debt – Cash

- Market cap (MC) is the total value of a company’s outstanding shares, calculated by multiplying the current share price by the number of shares in circulation.

- Total debt includes short-term and long-term liabilities, such as loans and bonds.

- Cash represents the liquid assets available to the company, including short-term cash equivalents, but excluding long-term marketable securities

The formula above provides a clearer view of a company’s total value by accounting for its debts and cash reserves.

Let’s take a look at an example using an EV case study of Microsoft (MSFT):

As of April 9, 2025, Microsoft’s market capitalization stood at approximately $3.13 trillion. The company reported a total debt of $60.46 billion, reflecting a significant increase from the previous year’s $29.6 billion.

Cash and cash equivalents were reported at $17.482 billion as of December 31, 2024.

Calculating Microsoft’s enterprise value case study (EV):

EV = Market Cap + Total Debt – Cash

EV = $3.13 trillion + $60.46 billion – $17.482 billion = $3.173 trillion

This calculation indicates that Microsoft’s enterprise value is approximately $3.173 trillion as of April 2025.

Example of enterprise value

Calculating Microsoft’s enterprise value (EV)

As of April 9, 2025, Microsoft’s market capitalization was approximately $3.13 trillion. The company reported a total debt of $60.46 billion, reflecting a significant increase from the previous year’s $29.6 billion. Cash and cash equivalents stood at $17.482 billion as of December 31, 2024.

The enterprise value (EV) provides a comprehensive measure of a company’s total value, considering its market cap, debt, and cash reserves.

For Microsoft, the EV calculation is as follows:

| Item | Amount (USD) |

| Market Capitalization | 3,130,000,000,000 |

| Total Debt | 60,460,000,000 |

| Cash and Cash Equivalents | 17,482,000,000 |

| Enterprise Value (EV) | 3,173,978,000,000 |

This calculation indicates that Microsoft’s enterprise value is approximately $3.174 trillion as of April 2025.

- Microsoft Enterprise Value = $3.13 trillion + $60.46 billion – $17.482 billion

- Microsoft EV = $3.173 trillion

Enterprise value provides a more complete view of a company’s worth. If someone were to purchase Microsoft’s shares at its market capitalization of $3.13 trillion, they would also need to take on the company’s $60.46 billion in debt.

The acquiring company would need over $3.18 trillion to purchase Microsoft. However, with $17.482 billion in cash and cash equivalents, this amount could offset some of the debt, bringing the total acquisition cost closer to $3.17 trillion.

Who can benefit from using the enterprise value formula?

Enterprise value is an important measure used by many business professionals to understand a company’s true worth. It’s used in mergers, acquisitions, and other financial decisions to help make more informed choices.

Let’s explore who can use enterprise value.

Bankers

In mergers and acquisitions, investment bankers use enterprise value to determine a company’s true worth. This helps them understand the full cost of a company, including its debts, which in turn helps them make decisions and negotiate deals. As digital banking adoption grows, the impact of technology on a company’s financials must also be considered, as it can affect valuation through factors like digital assets and online customer base.

Financial analysts

Digital finance transformation is changing how financial analysts use enterprise value to compare companies and understand their financial health. Paired with other numbers like EBITDA, it helps them figure out how well a company performs and whether it’s a good investment.

Investors

Enterprise value helps compare different companies. Since it includes both debt and cash, it gives a clearer picture of a company’s true value, making it easier for investors to compare companies in the same industry or market.

Why does enterprise value (EV) matter for businesses?

Enterprise value is crucial for businesses, providing a comprehensive measure of a company’s size and debt utilization.

A recent Research Gate paper noted, “It aims to help investors correctly evaluate the real value of enterprises and avoid investment damage when the domestic securities market is a weak, limited capital market and the intrinsic value of enterprises deviates from the market value.”

For instance, certain burgeoning tech stocks might appear excessively valued when solely assessed through market capitalization.

However, accounting for minimal or non-existent debt and subtracting a substantial cash reserve may reveal that the enterprise value provides a starkly distinct valuation compared to mere market cap.

How to calculate enterprise value (EV) multiples

Enterprise value (EV) is the foundation for various financial metrics used to gauge a company’s performance.

One such metric is the enterprise multiple, which connects a company’s total valuation from all funding sources to its operational earnings, represented by earnings before interest, taxes, depreciation, and amortization (EBITDA).

EBITDA provides insights into a company’s revenue drivers, offering an alternative to straightforward earnings or net income in certain scenarios:

- EBITDA = Net Income + Interest Expense + Taxes + Depreciation + Amortization

However, EBITDA may not always reflect the full picture, as it omits capital costs related to assets like property and equipment. When working capital increases, EBITDA may overstate cash flows from operations. It also overlooks the impact of different revenue recognition policies on a company’s operational cash flow.

Another popular valuation metric is the EV-to-sales ratio (EV/Sales). This ratio is more accurate than the Price/Sales metric because it determines a company’s debt obligations.

A lower EV/Sales ratio could suggest that a company is undervalued. In rare cases, if a company’s cash exceeds its market cap and debt, the EV/Sales ratio may be negative, indicating it can settle all its obligations.

What are the limitations of enterprise value (EV)?

Enterprise value (EV) has limitations, especially when comparing companies operating in different sectors or growth stages.

Let’s take a closer look at the limitations of enterprise value:

Debt and cash reserves distortion

Enterprise value (EV) shows the total cost to buy a company but doesn’t always explain how debt and cash affect a company’s financial health. Two companies might have the same market cap, but one could be weighed down by debt, while the other has lots of cash, making it cheaper to buy.

Industry differences in debt utilization

Different industries use debt in various ways. A software company with a lot of debt might look less attractive compared to another with the same market cap but no debt. However, industries like utilities or car manufacturing often need debt to buy assets required to run their business.

Company growth stage impact

The growth stage of a company also affects its EV. New or fast-growing companies usually have less debt than older, more established companies. Their enterprise value may not fully show the risks or potential compared to older firms in industries demanding a lot of investment.

Next steps for enterprise value

Enterprise value (EV) offers a more comprehensive view of a company’s worth, especially in the context of mergers and acquisitions.

Unlike market capitalization (market cap), which only reflects the total value of outstanding shares, EV accounts for crucial factors such as debt and cash reserves. While market cap provides insight into how the stock market values a company, it doesn’t capture the full financial picture.

Using EV helps investors assess a company’s scale and valuation more accurately, but it’s most effective when combined with other success metrics for a more complete analysis.

Ratios like EV/Sales, which indicates cash flow, and EV/EBITDA, which reflects earnings before interest and taxes, are commonly used to deepen this understanding.

People Also Ask

-

What is the difference between enterprise value and equity value?Enterprise value reflects the total cost to acquire a company, including debt and excluding excess cash. Equity value, however, represents the portion of this value that belongs to shareholders. It’s calculated by subtracting debt and adding excess cash to the enterprise value.

-

What is the difference between enterprise value vs. market cap?Market cap only reflects a companys stock value, ignoring debt and cash. However, enterprise value accounts for these factors, providing a fuller picture of a company’s worth. While market cap might seem similar, enterprise value shows a clearer difference in overall value when including debt and cash reserves.

-

What is the difference between enterprise value vs. P/E ratio?The P/E ratio looks at a company’s stock price relative to its earnings but ignores debt. On the other hand, enterprise value includes debt, providing a more complete view of a company’s true value. Both metrics should be considered together for a full analysis.

![18 Examples of AI in Finance [2025]](https://www.digital-adoption.com/wp-content/uploads/2025/06/18-Examples-of-AI-in-Finance-2025-300x146.jpg)

![14 Examples of AI in Manufacturing [2025]](https://www.digital-adoption.com/wp-content/uploads/2025/06/14-Examples-of-AI-in-Manufacturing-2025-300x146.jpg)

![29 Examples of AI in Education [2025]](https://www.digital-adoption.com/wp-content/uploads/2025/06/29-Examples-of-AI-in-Education-2025-300x146.jpg)

![15 Examples of AI in Retail [2025]](https://www.digital-adoption.com/wp-content/uploads/2025/06/15-Examples-of-AI-in-Retail-2025-300x146.jpg)

![13 Examples of AI in Healthcare [2025]](https://www.digital-adoption.com/wp-content/uploads/2025/06/AI-in-healthcare-examples-300x146.jpg)

![18 Examples of AI in Finance [2025]](https://www.digital-adoption.com/wp-content/uploads/2025/06/18-Examples-of-AI-in-Finance-2025.jpg)

![14 Examples of AI in Manufacturing [2025]](https://www.digital-adoption.com/wp-content/uploads/2025/06/14-Examples-of-AI-in-Manufacturing-2025.jpg)

![29 Examples of AI in Education [2025]](https://www.digital-adoption.com/wp-content/uploads/2025/06/29-Examples-of-AI-in-Education-2025.jpg)