Staying updated with the latest trends is critical, especially when it comes to property and casualty (P&C) insurance. Digital adoption in the insurance industry is growing and impacting how P&C insurers manage their business.

Understanding P&C insurance trends is not just about knowing what’s happening in the insurance sector. It’s about foreseeing potential threats and opportunities for your business.

These trends can provide you with insights that will help you make informed decisions on how to protect your business assets, manage risks, and even exploit new growth opportunities.

By keeping a finger on the pulse of these shifts, you can ensure your business is both reactive and proactive in an ever-changing business environment.

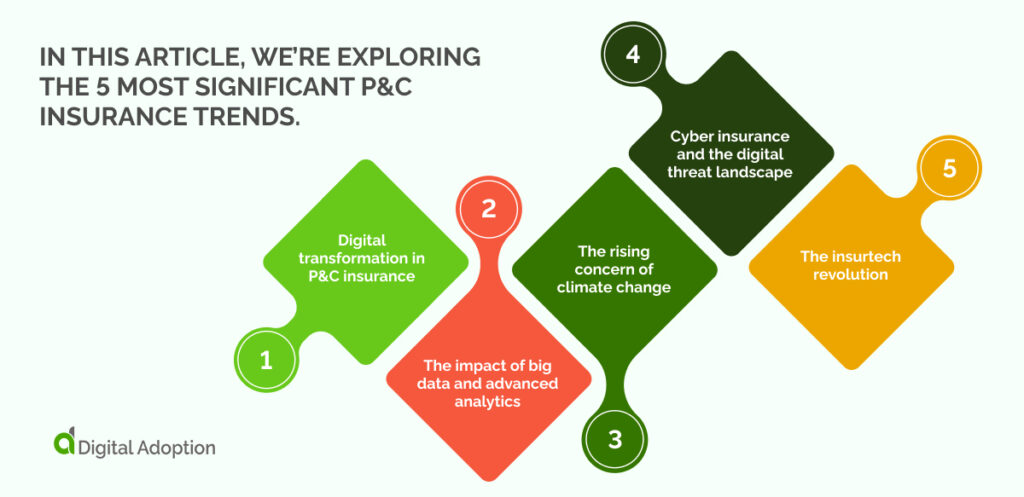

In this article, we’re exploring the 5 most significant P&C insurance trends.

We’ll be covering what P&C insurance professionals can expect from this year, how these trends could impact your business, and what you should do about it.

Trend #1: Digital transformation in P&C insurance

Digital transformation in the wider insurance sector is a well-sung example of a modern success story.

It’s more than just a switch from manual to electronic.

It’s about leveraging technology to enhance customer experiences, streamline operations, and make data-driven decisions. Today’s insurance customers expect seamless, quick, and digital-first interactions.

You can see the same results in the P&C insurance niche– a repeated testament to the power of digital transformation.

Adopting digital solutions can help you meet these expectations, increase operational efficiency, and stand out in a highly competitive market.

You can begin this transformation by identifying areas of your business operations that could benefit most from digital enhancement. This could be anything from client interactions, claims management, risk assessment, or data analysis.

Embracing digital transformation also means fostering a digital culture within your organization. Encourage your team to be open to new technologies and provide the necessary training and support to adapt to these changes.

Several insurance companies have successfully embraced digital transformation and are reaping the rewards.

Take Lemonade, for example.

They’re an insurtech company that uses AI and machine learning to streamline processes and offer a seamless customer experience. Claims that traditionally took days or weeks to process can be handled in seconds.

Their use of digital platforms to interact with customers has positioned them as a leader in customer satisfaction within the industry.

But we’ll take a closer look at insurtech companies later.

Trend #2: The impact of big data and advanced analytics

Big data refers to extremely large data sets that can be analyzed to reveal patterns, trends, and associations, especially relating to human behavior and interactions.

Advanced analytics involves the use of techniques like machine learning, predictive modeling, and statistical algorithms to analyze this data and draw meaningful insights.

In insurance, big data and advanced analytics can come from many sources, including IoT devices, social media, customer interactions, and business operations.

Together, they provide valuable insights that can drive decision-making and strategy in your business.

Traditionally, insurers relied on limited data points and historical records to calculate risk and determine premiums. But today, with the explosion of data and advanced analytics, you can make much more precise and personalized risk assessments.

For instance:

Data from IoT devices like smart home systems or connected cars can provide real-time insights into customer behavior, allowing for more accurate risk profiles.

Machine learning algorithms can analyze historical claims data to predict future claims.

These developments enable more precise pricing, which can lead to increased profitability and competitive advantage.

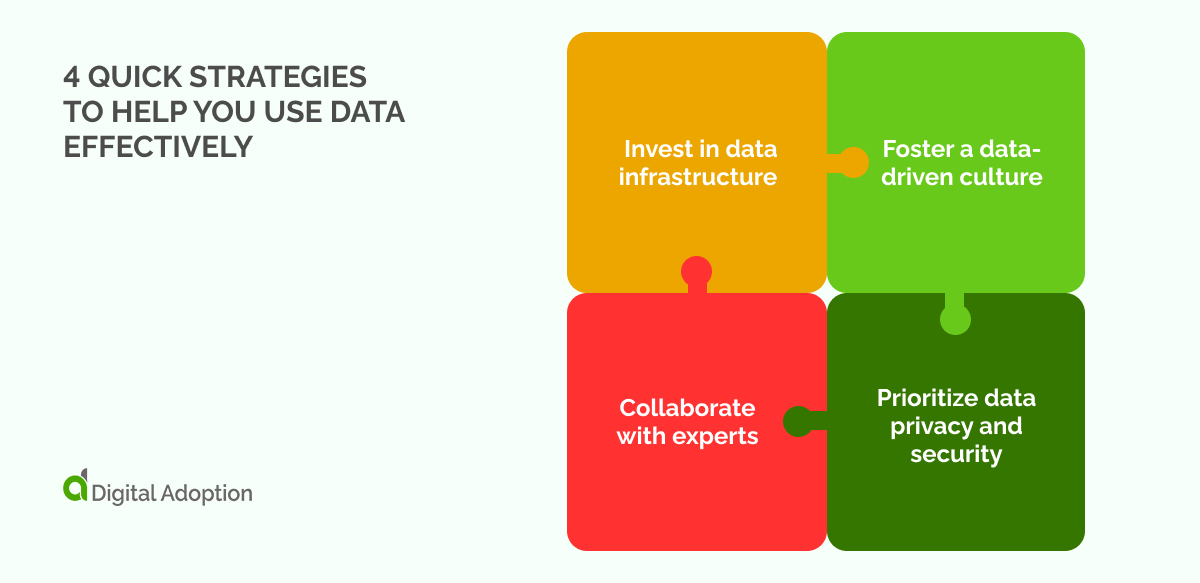

4 quick strategies to help you use data effectively

Data is the lifeblood of the dynamic pricing strategies often used by P&C insurance providers. As a leader in the space, you need to know how to manage data.

If you want to recognize the power of big data and advanced analytics and find ways to leverage them effectively, here are 4 quick strategies:

1. Invest in data infrastructure

To harness the power of data, you need robust infrastructure to collect, store, and analyze it.

This could involve cloud-based storage solutions, data management systems, and analytics tools.

2. Foster a data-driven culture

Encourage your team to use data in their decision-making processes.

You could create employee training programs to increase data literacy among your staff.

3. Prioritize data privacy and security

With great data comes great responsibility.

It’s essential to ensure that you have strong measures in place to protect customer data and comply with privacy laws.

4. Collaborate with experts

You don’t have to do it all alone.

Collaborating with data scientists, analytics experts, and technology providers can help you maximize the value you get from your data.

Trend #3: The rising concern of climate change

Climate change is not just an environmental concern, it’s increasingly a customer expectation.

Consumers are becoming more aware of climate change’s impacts and expect businesses, including you, to take responsibility and action.

They’re seeking insurers that align with their values, taking into account their approach to sustainability and environmental responsibility when choosing their insurance provider.

Many P&C insurers are creating innovative, eco-friendly insurance products and services in response to this demand.

Some insurers offer premium discounts or special packages for policyholders investing in green technology, like solar panels or electric vehicles, encouraging environmentally friendly practices.

Some insurers also invest a portion of their premiums into sustainable projects or renewable energy initiatives, reflecting their commitment to combatting climate change.

4 quick strategies to help you meet climate-conscious expectations

Understanding and addressing this shift in consumer expectations can be crucial for your company’s success.

Here are 4 quick strategies to help you build a more ethical business:

1. Develop green products and services

Consider offering incentives for customers who make environmentally friendly choices, like discounts for electric vehicle owners or those who install solar panels.

2. Communicate your commitment

Make sure your customers know about your efforts to combat climate change.

You can do this through marketing campaigns, corporate social responsibility reports, or public commitments to sustainability.

3. Engage with your customers

Understand your customers’ expectations around sustainability and look for ways to involve them in your green initiatives.

You could use surveys, focus groups, or community events to achieve this.

4. Partner for sustainability

Consider partnering with environmental organizations or getting involved in climate-focused initiatives.

This not only helps in the fight against climate change but also sends a strong message to your customers about your commitment to sustainability.

Remember, taking action on climate change is not just about managing risks or complying with regulations – it’s also about meeting customer expectations and building a brand that resonates with the increasingly climate-conscious consumer.

Doing so lets you differentiate your business in a competitive market and drive long-term success.

Trend #4: Cyber insurance and the digital threat landscape

As our world becomes increasingly digital, so do the threats we face.

Cyber threats, such as data breaches, ransomware attacks, and phishing scams, are on the rise, posing a significant risk to businesses large and small.

The fallout from such incidents can be substantial, including financial losses, reputational damage, and regulatory penalties.

In this context, the demand for cyber insurance has surged. This is a form of property insurance that covers cyber threats.

Cyber insurance can help businesses cope with the financial impact of cyber incidents, providing coverage for costs such as data recovery, legal fees, customer notification, and crisis management.

Despite the growing demand, assessing cyber risk presents several challenges for P&C insurers.

Unlike traditional risks, cyber threats are constantly evolving, making it difficult to predict and price accurately.

Also, the lack of historical data further complicates risk assessment.

Moreover, cyber risks can be systemic; a single event, like a widespread ransomware attack, can affect many businesses simultaneously, leading to large aggregate losses.

Trend #5: The insurtech revolution

Insurtech, as we touched on earlier, is a portmanteau of “insurance” and “technology.” It refers to the innovative use of technology to enhance and streamline the insurance industry.

Insurtech solutions range from digital platforms that simplify buying to artificial intelligence (AI) systems that automate claims processing.

These innovative solutions are disrupting the insurance industry by challenging traditional business models, increasing efficiency, and enhancing customer experiences.

For instance, insurtech is changing the way insurers assess risk, interact with customers, and process claims, introducing a new era of speed, accuracy, and customer-centricity.

Insurtech startups are at the forefront of this revolution, and there’s a lot that established insurers can learn from them.

For instance, insurtech startups typically prioritize a user-centric design, aiming to make the insurance process as simple and intuitive as possible.

They also harness data and analytics to offer personalized insurance products and improve risk assessment.

Another key lesson is the ability to adapt and innovate quickly. Many insurtech startups operate on lean business models that enable them to rapidly test, learn, and iterate on their offerings.

4 quick tips on integrating innovative technologies

While you might not be an insurtech startup, there are many ways to integrate innovative technologies into your existing business model – and it’s something the biggest insurance companies in the world are already working on.

KPMG’s CEO outlook survey conducted in 2020 found that:

- 46% felt the pace at which their organizations were digitizing operations had increased dramatically after the pandemic – putting them years ahead.

- 75% of the CEOs surveyed said that creating new digital business models and revenue streams have accelerated by a matter of months.

- 46% said they had seen an exponential increase in the rate at which companies were creating a seamless digital customer experience.

Embracing the insurtech revolution doesn’t mean completely overhauling your existing business model.

Instead, it’s about integrating innovative technologies to enhance your current operations and drive value for your customers.

Here are 4 quick tips to help you work like insurtech startups:

1. Partner with insurtechs

One of the easiest ways to harness insurtech is through partnerships.

Many insurtech startups offer white-label solutions that can be integrated into your existing processes.

2. Invest in innovation

Consider setting up an innovation lab or dedicating resources to explore and test new technologies.

This could involve hiring a team of data scientists or software engineers.

3. Prioritize customer experience

Use technology to enhance your customer experience.

You could do this through a mobile app, an intuitive website, or AI-powered customer service.

4. Leverage data

Use advanced analytics to draw insights from your data and make more informed decisions.

This could involve predictive analytics, machine learning, or AI.

A new era in P&C insurance

From the digital transformation reshaping the industry to the rise of big data and advanced analytics, the world of P&C insurance is rapidly evolving.

We’ve seen how consumer demand for climate consciousness is causing insurers to rethink their products and strategies and how cyber insurance is growing in response to the increasing threat of digital risks.

Changes are afoot on the regulatory front, with new rules around data protection, solvency, and climate risk disclosure creating challenges and opportunities.

And finally, the insurtech revolution is injecting innovation into the sector, offering new ways to enhance efficiency and improve customer experiences.

It’s essential to understand these trends and the impacts they could have on your business.

But more than that, it’s about seeing the opportunities they present.

Whether it’s using data to make more informed decisions, harnessing technology to enhance your customer experience, or offering innovative products that align with your customers’ values, these trends offer avenues for you to differentiate your business and gain a competitive edge.

The future of P&C insurance is undoubtedly complex and challenging, but it’s also ripe with potential.

By staying informed, being proactive, and embracing innovation, you can navigate this dynamic landscape successfully and lead your business to thrive in the new era of insurance.