Digital finance transformation refers to the integration of digital technology into all areas of financial services with the fundamental goal of improving and automating business processes, enhancing customer experience, and helping leaders make better decisions.

Many Chief Financial Officers (CFOs) and other finance professionals think digital transformation is outside of their wheelhouse – it’s a job for IT.

We don’t agree.

Digital finance transformation isn’t only about adopting new technology to help you do your job.

Rather, digital adoption can completely rehaul how your business operates and create new opportunities for you to deliver value to your stakeholders.

The finance industry has relied on manual processes and face-to-face interactions for decades.

Whether it was applying for a loan, performing transactions, or managing accounts, the traditional processes were paper-intensive and often time-consuming.

However, the digital era has ushered in unprecedented changes.

The rise of the internet and mobile devices has changed how consumers interact with financial services.

This, coupled with advances in data analytics, cloud computing, artificial intelligence, and blockchain technology, has provided leaders in finance with tools to revolutionize their services.

In this article, we’re delving deep into what digital finance transformation is, and what you can do to position your business for success in a tech-driven competitive landscape.

We’ll cover all the benefits to help you create strong business cases for digital adoption. We’re also sharing your challenges, so you can be fully prepared.

By the time you’re done reading, you’ll know everything about digital finance transformation.

- Understanding the need for digital finance transformation

- Different kinds of digital finance transformation

- Benefits of digital finance transformation

- Challenges and potential barriers to digital finance transformation

- Future trends in digital finance transformation

- Digital finance transformation: Getting it right

Understanding the need for digital finance transformation

Forrester found in 2021 that at least 25% of CFOs were making digital transformation one of their priorities.

Many factors are fuelling this change, but we think it really boils down to two key drivers:

- The changing expectations of the modern customer

- The need for improved operational efficiency and performance

Today’s customers are more informed and connected than ever before. They expect seamless, convenient, and instant services at their fingertips.

The patience for long queues and extensive paperwork is waning. In the financial sector, this means rising expectations of swift transactions, real-time updates, personalized services, and round-the-clock accessibility.

Digital finance transformation helps meet these escalating expectations by using technology to deliver customer-centric services.

On top of that, in an increasingly competitive market, businesses like yours are under pressure to attract and retain customers and improve their bottom lines.

Operational efficiency and effectiveness are the keys to achieving these objectives.

Digital finance transformation, through automation and data analytics, enables you to streamline your processes, reduce errors, and make data-driven decisions.

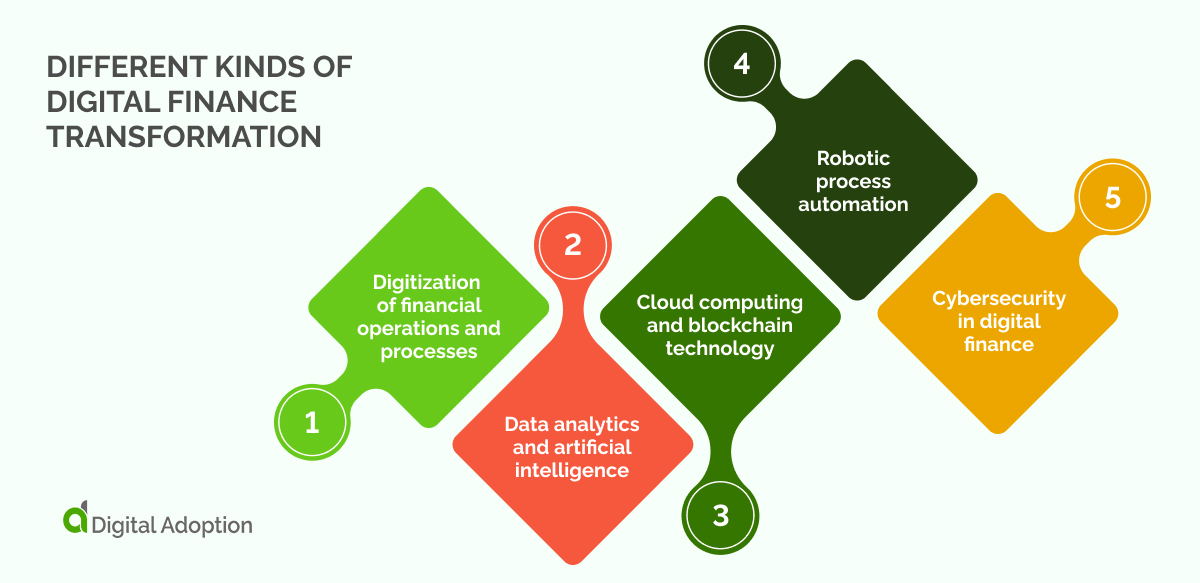

Different kinds of digital finance transformation

Finance is a multi-faceted industry, so digital finance transformation is a multi-faceted process.

Understanding the various kinds of digital finance transformation out there is important. Not only should these inspire your own ideas, but they should alert you on what to watch out for from your competitors.

Let’s take a look at a few of the ways industry leaders use digital finance transformation:

Digitization of financial operations and processes

The foundation of digital finance transformation lies in digitizing operations and processes.

This means converting manual processes such as data entry, transactions, and document verification into automated digital procedures. You can streamline operations, reduce processing time, and minimize errors through digitization.

Furthermore, digitization makes it possible to offer services online or through mobile apps, allowing your customers to access financial services anytime, anywhere.

Data analytics and artificial intelligence

In the digital era, data is the new currency.

Data analytics involves processing vast amounts of data to glean insights and make informed decisions.

Artificial intelligence (AI) can analyze data patterns and make predictions or recommendations.

These technologies can be used for fraud detection, risk assessment, and market forecasting.

AI chatbots, for example, are increasingly used in customer service to handle queries and provide instant responses.

Cloud computing and blockchain technology

Cloud computing lets you store and access data and applications over the internet rather than on physical servers.

This reduces the need for physical infrastructure, lowering costs and improving scalability.

On the other hand, blockchain technology allows for the secure and transparent recording of transactions.

This has profound implications for the financial industry, particularly in areas like payments, settlements, and trade finance, where integrity and trust are paramount.

Robotic process automation

Robotic Process Automation (RPA) involves using software robots or ‘bots’ to automate repetitive tasks previously done manually.

You can apply RPA to transaction processing, compliance reporting, and data reconciliation processes.

Automating these processes can significantly reduce costs, improve accuracy, and free up human resources for more strategic tasks.

Cybersecurity in digital finance

As financial services become increasingly digital, cybersecurity emerges as a critical component.

Protecting sensitive financial data and ensuring the integrity of financial transactions is paramount.

Cybersecurity in digital finance encompasses a range of practices and technologies designed to protect systems, networks, and data from cyber threats.

This includes encryption, authentication, intrusion detection systems, and ongoing monitoring and assessment of security controls.

In summary, digital finance transformation is not about implementing a single technology but rather integrating a suite of technologies and practices to overhaul how your business operates and serves its customers.

Together, These elements enable you to be more efficient, agile, and customer-centric, paving the way for a more innovative and responsive financial industry.

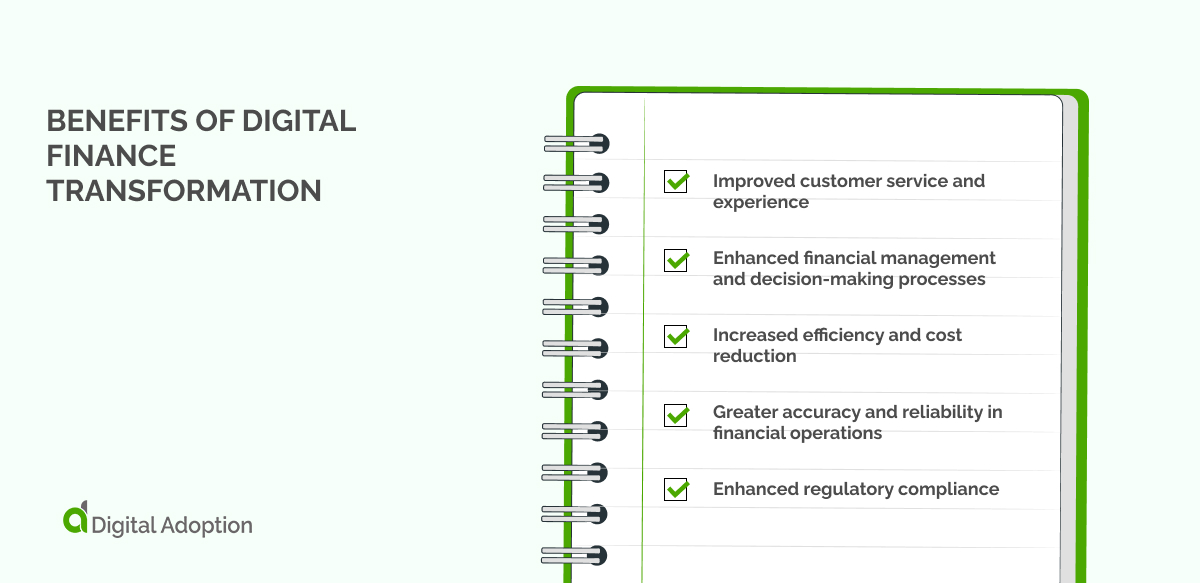

Benefits of digital finance transformation

Embracing digital finance transformation can yield plenty of benefits.

Having a good grip on what you stand to gain before you set out on a digital transformation journey can help you see things through, keep you motivated, and help you initially set goals.

Presenting a robust list of potential benefits also helps you get buy-in from leadership.

Here are a few of the most common and compelling benefits of digital finance transformation:

Improved customer service and experience

One of the most apparent benefits of digital finance transformation is the significant improvement in customer experience transformation.

By using digital platforms, you can offer customers 24/7 access to services.

Furthermore, with the help of chatbots and AI, you can address customer queries more promptly and efficiently.

Personalization, facilitated by data analytics, also allows you to offer tailored products and services, enhancing customer satisfaction and loyalty.

Enhanced financial management and decision-making processes

Digital finance transformation empowers you with data-driven insights crucial for effective financial management and decision-making.

With access to real-time data, you can make more informed decisions regarding investments, risk management, and resource allocation.

Artificial intelligence and machine learning enhance these processes by providing predictive analytics and automating complex data analyses.

Increased efficiency and cost reduction

Automation plays an important role in increasing operational efficiency and reducing costs.

By automating repetitive and manual tasks, you can cut down on processing times and human errors.

This leads to faster and more efficient services and significantly reduces operational costs.

Greater accuracy and reliability in financial operations

Through a workflow automation strategy and data analytics, you can minimize the scope for human error, enhancing the accuracy and reliability of financial operations.

Whether it’s transaction processing, compliance reporting, or risk assessment, digital tools ensure your employees can carry out these processes precisely.

Enhanced regulatory compliance

The financial industry is often subject to constricting regulations. Managing and staying compliant with these regulations can be daunting.

Digital finance transformation eliminates this burden by automating compliance processes and keeping a digital record of all transactions and activities.

This ensures that you’re always in compliance with regulatory requirements and makes it easier to provide documentation and reports when required.

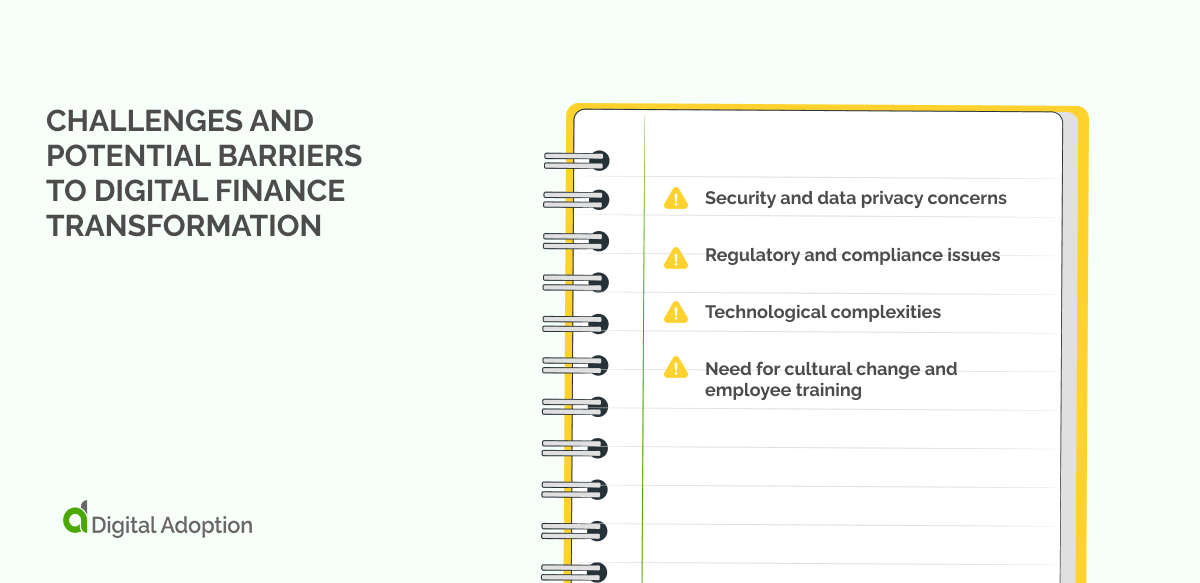

Challenges and potential barriers to digital finance transformation

While digital finance transformation promises to revolutionize the financial industry, it also presents its fair share of challenges and potential barriers.

You need to navigate these hurdles effectively to reap the benefits of transformation.

These are the challenges we believe to be the most pressing and common:

Security and data privacy concerns

As you embrace digital technologies, you’re also exposed to various cybersecurity threats.

Data breaches and other cyber-attacks have become major concerns with increasingly sensitive data being processed and stored digitally.

The challenge lies in ensuring sufficient security measures are in place to protect customer data and maintain trust.

Regulatory and compliance issues

The financial sector is highly regulated, and these regulations are constantly evolving.

Digital transformation may sometimes create friction with existing regulations. For instance, employing new technologies may mean subscribing to new sets of regulatory standards.

Keeping up with these changing regulations and ensuring compliance can be challenging and resource-intensive.

Technological complexities

Implementing new technologies is not always a straightforward task.

Integrating various systems, ensuring their compatibility, and managing the intricacies of new technologies can be highly complex.

Moreover, as technologies evolve, the additional challenge is ensuring that the systems stay updated and relevant.

Need for cultural change and employee training

Digital finance transformation is not just about technology but also about people.

Changing the way your organization operates often requires a change in organizational culture.

You need to train employees to work with new technologies, and you might need to hire talent with specialized skills.

Additionally, you need to foster a culture that embraces innovation and change, which can be a significant challenge in businesses that use traditional methods.

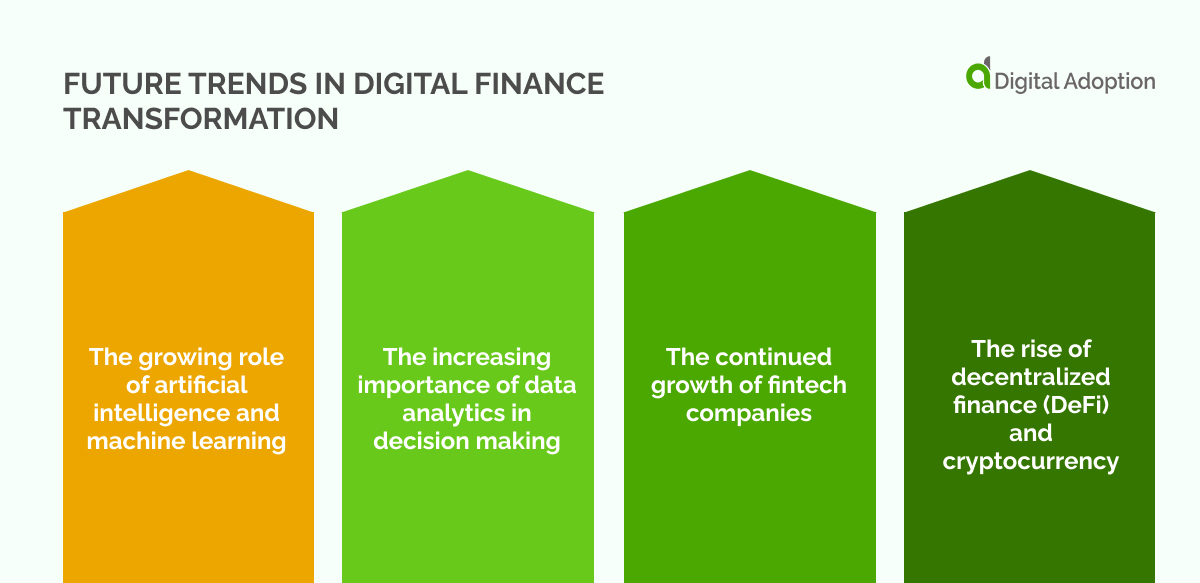

Future trends in digital finance transformation

Digital finance transformation is not a destination but an ongoing journey.

With technological innovations at an all-time high, you must keep an eye on future trends that could shape the landscape of digital finance transformation.

Take a moment to familiarize yourself with the top 4 digital finance transformation trends in 2023:

The growing role of artificial intelligence and machine learning

Artificial Intelligence (AI) and Machine Learning (ML) have already significantly impacted the financial industry, and their role is expected to grow in the future.

From personalized banking and risk assessment to fraud detection and investment advising, AI and ML will become more integral in automating and optimizing financial services.

Moreover, as these technologies continue to evolve, they will likely lead to the developing of new products and business models that we can’t yet envision.

The increasing importance of data analytics in decision making

Data has become one of the most valuable assets for financial institutions.

As the volume and variety of data continue to increase, so does the potential to harness this data for decision-making.

Data analytics will become even more critical for financial institutions, not just for understanding customer behavior but also for market analysis, forecasting, and real-time decision-making.

The future will likely see even more advanced analytics tools and platforms that make it easier for financial institutions to glean actionable insights from large datasets.

The continued growth of fintech companies

Fintech companies have been at the forefront of digital finance transformation, often acting as disruptors to traditional financial institutions.

This trend is expected to continue, with more fintech companies emerging and existing ones expanding their services.

These companies often have the advantage of being more nimble and innovative compared to traditional banks and financial institutions, and they will continue to push the boundaries of what’s possible in the financial sector.

The rise of decentralized finance (DeFi) and cryptocurrency

Decentralized finance, or DeFi, is a relatively new development that has been gaining traction. #

DeFi refers to financial services that use blockchain technology without traditional intermediaries. This includes lending platforms, decentralized exchanges, and more.

Alongside DeFi, the adoption of cryptocurrencies is on the rise.

As blockchain technology continues to evolve, we can expect DeFi and cryptocurrency to play an increasingly significant role in the financial industry, potentially reshaping how financial transactions are conducted on a fundamental level.

Digital finance transformation: Getting it right

The landscape of digital finance transformation is constantly changing, driven by technological innovations and changing consumer preferences.

You need to stay abreast of these trends and be willing to adapt and innovate to thrive in the evolving financial ecosystem.

It absolutely pays to make the first move and be a digital-first financial institution.

“…it turns out that first movers have a big advantage in digital,” says Tanguy Catlin, Mckinsey Senior Partner. “They learn more and faster. That, again, means the CFO has to be willing to learn quickly and double down on a bet that seems to be paying off.”

The future of digital finance transformation holds exciting possibilities, and those who are able to harness these emerging trends will be well-positioned to succeed.