The upper limits of AI in business are yet to be reached.

The zeal to explore this potential has spurred on AI adoption in every industry, from small and medium-sized enterprises (SMEs) to industry-leading firms, such as Amazon and Microsoft.

Swift and secure financial systems are relied upon by businesses and customers globally. Tightly run and highly refined operational parameters act as an essential cog, keeping financial operations on track.

The gains of AI in finance promise heightened efficiency for today’s financial institutions and are helping to fuel digital finance transformation across the sector.

This article explores eighteen examples of AI in finance, from models that redefine process norms to AI-augmented cybersecurity and bleeding-edge AI FinTech, which helps transform online banking and customer experiences (CX).

AI in finance examples at a glance:

| AI Technology | Function | Category |

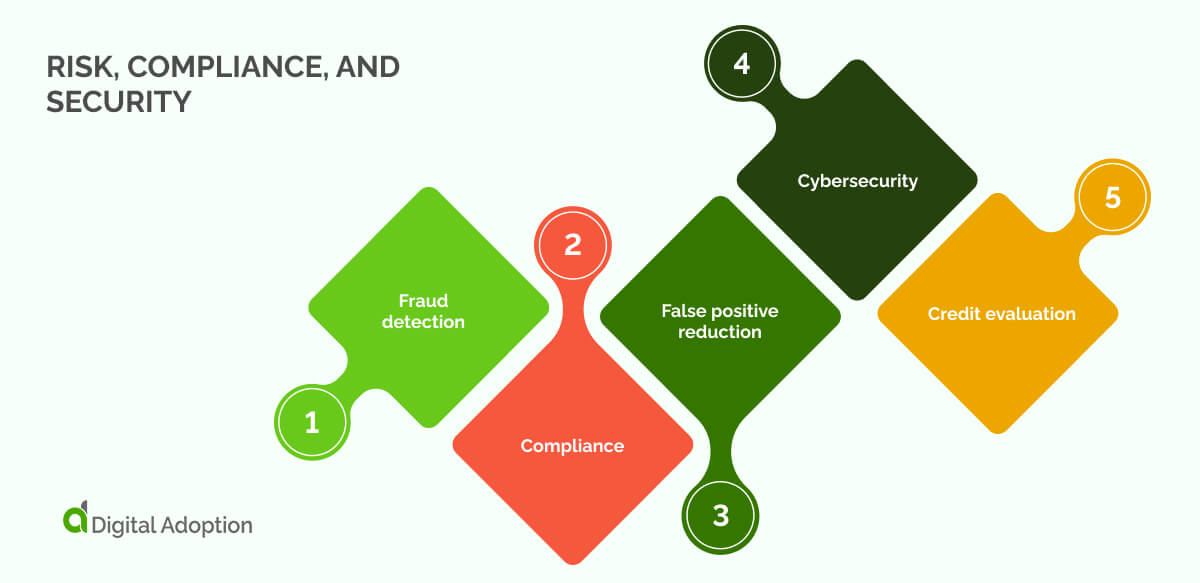

| Fraud detection | Flag unusual spending or access patterns using real-time transaction scans. | Risk, compliance, and security |

| Compliance | Reviews contracts and logs to check if rules and timelines are followed. | Risk, compliance, and security |

| False positive reduction | Filters alerts by comparing flagged activity to known customer habits. | Risk, compliance, and security |

| Cybersecurity | Tracks login behavior, geolocation, and device use to block threats early. | Risk, compliance, and security |

| Credit evaluation | Scores borrower risk by analyzing payment history, income patterns, and job data. | Risk, compliance, and security |

| 24/7 chatbot support | Answers account questions and resets passwords without staff input. | Customer experience and interaction |

| Customer service | Sorts and routes messages based on complaint type or urgency. | Customer experience and interaction |

| Personal finances | Tracks user spending, labels it by category, and flags budget spikes. | Customer experience and interaction |

| Robo-advisory | Builds low-risk or high-yield portfolios based on risk answers and age. | Customer experience and interaction |

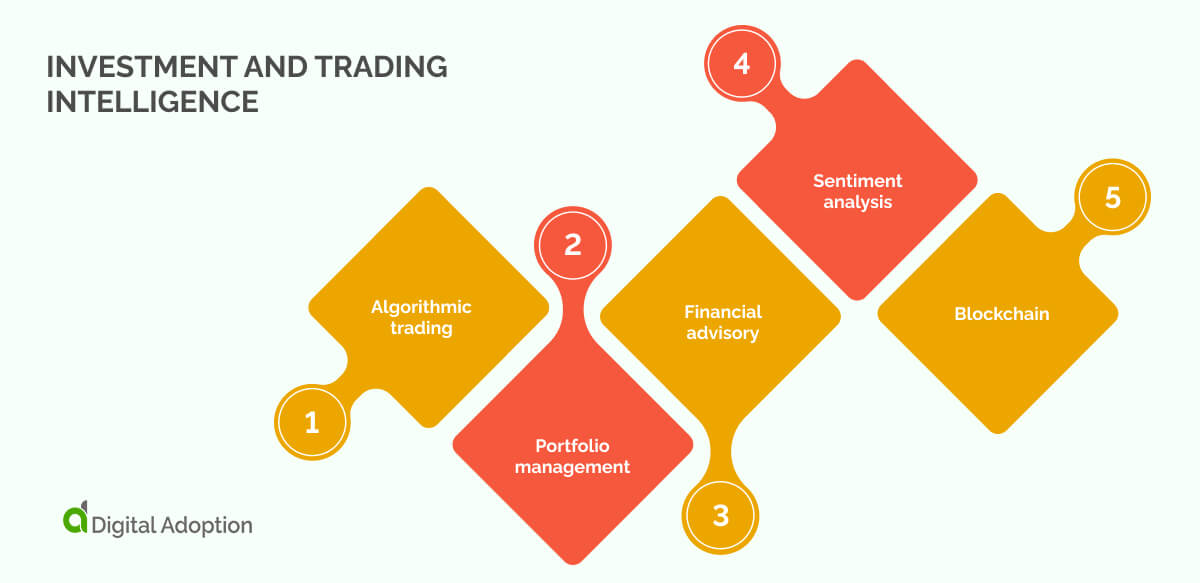

| Algorithmic trading | Auto-places trades by comparing price trends to preset entry points. | Investment and trading intelligence |

| Portfolio management | Rebalances assets when market weightings or goals change. | Investment and trading intelligence |

| Financial advisory | Suggests bond, stock, or fund mixes based on age, income, and goals. | Investment and trading intelligence |

| Sentiment analysis | Reads news, earnings calls, and posts to score investor mood on stocks. | Investment and trading intelligence |

| Blockchain | Lock transactions steps into time-stamped blocks that no one can change. | Investment and trading intelligence |

| Process automation | Transfers customer data between platforms without human input. | Operational efficiency and automation |

| Predictive analytics | Uses past account activity to forecast account balances or cash flow dips. | Operational efficiency and automation |

| Reporting | Auto-fills reports using flagged events, customer metrics, or account data. | Operational efficiency and automation |

Risk, compliance, and security

These examples will be divided into four distinct categories that best characterize the largest domains of finance in which AI is having an impact.

Let’s start with a core pillar of modern financial operations: risk, compliance, and security.

Fraud detection

Mitigating fraud, identity theft, and unauthorized transactions requires firms to adhere to proactive cybersecurity measures. This includes monitoring systems, assessing risks, managing threats, and developing software to keep pace.

The time and resource demand can be halved with AI. Machine learning (ML) models can auto-detect fraud, freeze transactions, and alert users without the need for human input. Differences in user typing speeds, haptic movements, and device orientation can even be picked up by AI, analyzing biometric behaviour that adds an extra security layer.

Compliance

Financial firms must adhere to stringent laws and regulations that inform end-to-end financial operations to ensure AI compliance. This often demands a dedicated team to ensure all activity remains in accordance with an endless number of criteria.

AI can absorb globally recognized laws and regulations, updating its understanding as laws change in reality. Pattern recognition also enables AI to detect early warning signs (I.e., repeated irregularities across accounts) that may indicate emerging compliance risks before they fully materialize.

False positive reduction

AI is learning to verify its guesses. False positives occur when legitimate activities, transactions, and payments are flagged as fraud and blocked automatically. These missteps create sluggish processes and frustrate customers.

ML cuts these errors by understanding customers’ spending habits, most frequented retailers, login patterns, etc.

Instead of suspensions triggered by slight deviations in account activity, AI builds user-specific patterns. It learns from feedback, re-labels past errors, and resets thresholds. More self-supervised learning means fewer blocked accounts, less user frustration, and more time spent chasing real threats.

Cybersecurity

AI is now helping reinforce digital safeguards in finance. It conducts quiet checks across background traffic, monitoring for strange movements between servers. Away from honing in on known attack types, AI learns a baseline for normal behavior, then observes for subtle variations. Multiple models can support a cybersecurity apparatus.

One model tracks unusual login paths. Another picks up code patterns inside incoming emails or links. Each flag is timed, traced, and stored. Over time, response speeds increase.

Credit evaluation

Financial customers can monitor their credit status using AI models that adapt and update in response to changes.

AI performs credit evaluations by simultaneously assessing various data sources. Past purchases, loans, transaction records, regular ingoing and outgoing expenses, and repayment histories are all aggregated to make a holistic assessment.

Scores aren’t static or assigned fixed weights; small changes in customer behaviour, such as successfully repaying a loan or a pattern of missed payments, will update scores live, without needing to be greenlit by human agents.

Customer experience (CX) and interaction

This next category is about how AI supports enhanced customer experiences (CX) and interactions in finance. These examples highlight customer-facing AI tools, such as mobile banking apps or 24/7 available AI agents, the section’s first example.

24/7 chatbot support

Lengthy wait times in branches or queues on the phone are slowly fading. AI agents powered by agentic AI are stepping in. Human representatives were expected to handle everything from simple questions to complex fraud cases. Now their time is spent on cases that require human judgment.

Traditionally, eCommerce chatbots could only perform set actions within confined parameters. Today, natural language agents work around the clock. They answer questions, issue refunds, freeze accounts, approve transfers, and move money, protected at all times by layered verification.

Customer service

Customers who have dealt with service AI agents in the past have been met with pre-scripted responses. These static interactions were limited, as they were unable to gauge human sentiments in real-time.

Clever use of ML, natural language processing (NLP), and voice recognition work in tandem to create customer service agents able to interpret user tone, word choice, and past conversations.

Stored memory enables agents to follow conversational threads, remembering past requests and pain points. With AI’s cross-functional services that eliminate redundant or repetitive steps, customers can save time and have their issues solved quickly.

Personal finances

Customers can pay extra attention to their financial health with AI-assisted financial management.

They can access holistic views of buying and spending habits, spotting behaviour patterns that could signal budgeting strains down the line. AI forecasts payment delays by comparing outgoing and ingoing costs and upcoming needs.

If savings are used, it suggests budgeting shifts or cutbacks. Personalized alerts flag due payments, budget limits, and savings. Users no longer need to micromanage their finances, as AI can augment much of the heavy lifting.

Robo-advisory

Robo-advisors use AI to offer automated, low-cost investment advice. They analyze user goals, risk tolerance, and market trends to build and manage portfolios in real-time. Unlike traditional advisors, they work 24/7 and adjust strategies based on live data.

Users receive personalized insights without needing to track every market move. These tools make wealth management more accessible, especially for first-time investors or those managing smaller portfolios without compromising on quality.

Investment and trading intelligence

AI is sharpening the edge of financial decision-making, moving beyond automation to insight. This section examines how firms utilize intelligent systems to refine their strategies, read markets in real-time, and unlock new forms of trading intelligence.

Algorithmic trading

AI systems scan markets second by second, responding faster than any human trader. They look for price inefficiencies, arbitrage opportunities, and repeating technical patterns. Rules are set, but the strategy evolves with incoming data.

Financial firms use this to place high volumes of trades with precision, often across global markets. Speed matters, but so does timing, and these models act the moment signals shift, cutting lag and manual guesswork.

Portfolio management

Portfolios aren’t static; they evolve in response to changing risk levels, market volatility, and shifting investor goals. Automated systems monitor each asset, rebalancing based on real-world performance, not just scheduled check-ins.

A dip in one sector or a policy shift can trigger small but precise adjustments. These systems also account for cash flow patterns, tax implications, and asset correlation. Over time, they build a clearer picture of what consistently holds value.

Financial advisory

Recommendations feel less generic when based on real behavior, not just averages. Financial planning tools now test scenarios in seconds, from early retirement to education funds, factoring in income patterns, debt levels, and spending habits.

Instead of static charts, advisors get evolving insights they can use in client discussions. The focus shifts from guesswork to forward-looking options. For many, this brings clarity to long-term choices once seen as too complex.

Sentiment analysis

Markets move on emotion just as much as economics. Trading models track how people talk about brands, currencies, and sectors across social media, earnings calls, and investor forums.

Sudden shifts in tone or frequency can act as early signals, well before price moves confirm them. It’s not about volume alone; context matters. Sentiment patterns help traders spot trends shaped by optimism, fear, or public reaction.

Blockchain

Transaction records are immutable, but activity patterns still need oversight. Digital technology examples include smart contract auditing tools, transaction flow trackers, and decentralized analytics dashboards. Monitoring tools now scan blockchain networks for unusual transfers. These systems help surface hidden risks, flagging discrepancies that might go unnoticed in manual reviews.

Each contract can be reviewed against real-world inputs, delivery dates, asset prices, or legal events before it’s executed. Disputes shrink when conditions adapt to changing facts. This brings more precision and fewer blind spots to blockchain-based financial systems.

Operational efficiency and automation

The last category is operational efficiency and automation. It tackles the hidden friction in daily workflows, transforming manual steps into precise and consistent actions that reveal new insights without complicating the system.

Process automation

Manual steps like entering data or matching transactions slow teams down. Digital process automation (DPA) software now handles these tasks nonstop, following clear instructions without error. When something unusual pops up, it’s flagged for review.

Digital workflows can adjust as rules shift, so processes stay current without extra effort. The outcome is faster, more dependable operations that let people focus on what machines can’t do.

Predictive analytics

Looking at past financial data reveals patterns that hint at what’s coming next. Models use this history to forecast risks like loan defaults or payment delays before they happen.

With each new data point, predictions get sharper. This insight helps teams act early, avoid surprises, and adapt strategies with better timing.

Reporting

Accurate numbers don’t wait for month-end. Automated reporting pulls data from many places, checks it, and delivers updates on cash flow, compliance, or investments right when needed.

Reports highlight unusual activity fast, so issues don’t linger unseen. Interactive dashboards let users dig into details easily, avoiding manual number crunching and clarifying financial information for everyone involved.

Ensuring AI in finance remains risk-free

AI in finance is quietly being implemented behind the scenes to make financial management easier and more secure for everyone.

In the short term, the goal is to create fair, equal, and secure systems that adapt to the nuances at the intersection of life and technology.

These foundations will help build stability and resilience as technology and finance continue to grow together.

However, there must also be an onus to limit AI risk management and ensure these systems remain transparent, accountable, and accessible to prevent new vulnerabilities as they scale.

People Also Ask

-

Who are the key stakeholders of AI in finance?Banks, regulators, tech firms, and customers shape AI in finance. Banks build and use AI tools. Regulators watch over fairness and security. Tech companies develop the underlying systems. Customers rely on AI for safer, smarter services that adapt to their needs.

-

How does AI benefit portfolio optimization in finance?AI tracks market shifts and updates portfolios in real time. It balances risk and return by learning patterns in data and adjusting investments without delay. This helps portfolios respond faster to change and uncovers chances that traditional methods might miss.

-

What are the challenges of AI in finance?Data quality, algorithm bias, and regulatory demands create challenges. Keeping AI decisions clear and systems secure is essential. Many firms also struggle to integrate AI with older infrastructure, while building trust among users remains a constant hurdle.

FACT CHECKED

FACT CHECKED![18 Examples of AI in Finance [2025]](https://www.digital-adoption.com/wp-content/uploads/sites/11/2025/06/18-Examples-of-AI-in-Finance-2025.jpg)